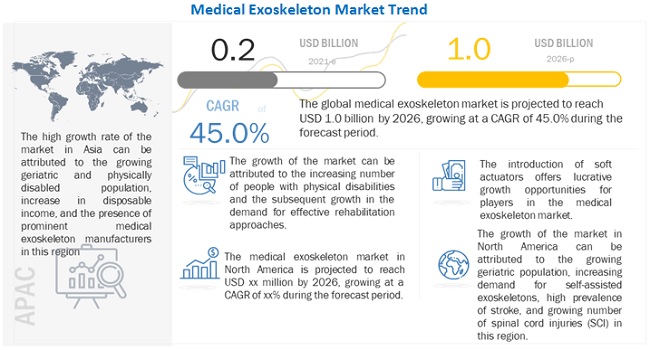

According to the new market research report “Medical Exoskeleton Market by Component (Hardware (Sensor, Actuator, Control System, Power Source), Software), Type (Powered, Passive), Extremities (Lower, Upper and Full Body) & Mobility (Mobile, Stationary) – Global Forecasts to 2026″, published by MarketsandMarkets™, is projected to reach USD 1.0 billion by 2026, from USD 0.2 billion in 2021, at a CAGR of 45.0%.

Opportunity: Increasing insurance coverage for medical exoskeletons in several countries;

Assistive devices are an essential part of healthcare. In several countries, many rehabilitation centers use assistive devices provided by government organizations, special agencies, insurance companies, and charitable and non-governmental organizations.

Currently, coverage for the exoskeleton technology by insurance companies is low in several countries. However, companies are focusing on framing policies and entering into strategic collaborations and agreements with various public and private insurance providers for the reimbursement of medical exoskeleton devices. For instance, Ekso Bionics is approaching the Centers for Medicare and Medicaid Services and third-party insurers as they are expected to play an important role in the long-term commercial adoption of the Ekso GT device.

In March 2021, ReWalk Robotics entered into a contract with BKK Mobil Oil Insurance to provide ReWalk Personal Exoskeleton devices to its eligible beneficiaries with spinal cord injury. This contract provides, eligible individuals can receive a ReWalk Personal 6.0 exoskeleton, which enables them to stand and walk in their homes and communities after completing the training program.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138546702

The growth of this market is mainly driven by factors such as the increasing number of people with physical disabilities and subsequent growth in the demand for effective rehabilitation approaches; agreements and collaborations among companies and research organizations for the development of the exoskeleton technology, and increasing insurance coverage for medical exoskeletons in several countries driving the growth of the medical exoskeleton market. However, the high cost of medical exoskeletons may restrict market growth to a certain extent.

The companies have a large market spread across various countries in North America, Europe, Asia, and the Rest of the World.

Impact of Covid-19 on The Medical Exoskeleton Market

As of September 2021, more than 220 million confirmed cases of COVID-19 were reported globally, with more than 4.5 million deaths (Source: WHO). This situation has compelled governments across the world to take proactive measures to contain the outbreak.

The COVID-19 pandemic had a negative impact on the market in 2020, with small and medium-sized companies struggling to sustain their businesses. The medical exoskeleton market is witnessing a variable growth trend, with some countries offering some growth potential while others are facing closures and low profit margins. Major exoskeleton providers, such as Ekso Bionics, ReWalk Robotics, and Hocoma AG, have incurred a reduction in overall revenue for the fiscal year 2020 due to a decline in the demand for exoskeleton systems. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to the demand from OEMs. Tier 1 players experienced a decline in revenue in the remaining quarters of 2020. Moreover, medical exoskeleton manufacturers are facing disruptions in supply chains as countries are under lockdown to prevent the spread of the disease.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=138546702

The hardware segment accounted for the largest share 78.6% of the medical exoskeleton market

by component, segmented into hardware and software. The hardware segment is expected to account for the largest share 78.6% of the medical exoskeleton market in 2020. The dominant share of this segment is attributed to the fact that a large number of parts such as sensors, actuators, power sources, and control systems are required to manufacture exoskeletons.

The lower extremity segment accounted for the largest share 63.0% of the medical exoskeleton market

By extremity, segmented into lower extremity medical exoskeletons and upper extremity medical exoskeletons and Full Body extremity medical exoskeletons. In 2020, the lower extremity medical exoskeletons segment is expected to account for a larger share of 63.0% of the market. Lower extremity exoskeletons provide stability to paralyzed and geriatric patients and offer weight-bearing and locomotion capabilities. As a result, their adoption is higher in the rehabilitation of patients.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=138546702

North America accounted for the largest share 44.4%. of the global medical exoskeleton market

Based on the region, segmented into North America, Europe, Asia, and the Rest of the World (RoW). In 2020, North America is expected to dominate the market with a share of 44.4%. The growing geriatric population, increasing demand for self-assist exoskeletons, high prevalence of stroke, and growing number of spinal cord injuries (SCI) are the key factors driving the growth of the exoskeleton market in this region.

Some of the leading players in the Medical exoskeleton market include Key players in this market are Ekso Bionics Holdings, Inc. (US), ReWalk Robotics Ltd. (Israel), Parker Hannifin Corp (US), CYBERDYNE Inc. (Japan), Bionik Laboratories Corp (Canada), Rex Bionics Ltd. (UK), B-TEMIA Inc. (Canada), Hocoma AG (a subsidiary of DIH Technologies) (Switzerland), Wearable Robotics SRL (Italy), Gogoa Mobility Robots SL (Spain), and ExoAtlet (Luxembourg)