fintech blockchain market share, fintech blockchain market growth, fintech blockchain industry analysis, fintech blockchain market size, fintech blockchain market top players, fintech blockchain market drivers

The fintech blockchain global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

FinTech Blockchain Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size –

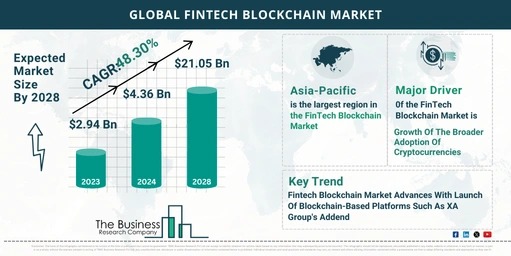

The fintech blockchain market size has grown exponentially in recent years. It will grow from $2.94 billion in 2023 to $4.36 billion in 2024 at a compound annual growth rate (CAGR) of 48.1%. The growth in the historic period can be attributed to enhanced security, cost reduction, increased efficiency, regulatory compliance, rising adoption of cryptocurrencies, innovation in financial services, partnerships and collaborations.

The fintech blockchain market size is expected to see exponential growth in the next few years. It will grow to $21.05 billion in 2028 at a compound annual growth rate (CAGR) of 48.3%. The growth in the forecast period can be attributed to growing demand for cross-border payments, increased investment and funding, consumer demand for privacy and control, innovation in financial services, regulatory compliance, partnerships and collaborations, expansion into new industries. Major trends in the forecast period include advancements in blockchain technology, rise of decentralized finance, integration of artificial intelligence (AI) and machine learning (ML), expansion of blockchain use cases, emergence of central bank digital currencies, increasing interoperability between blockchain networks, adoption of blockchain in supply chain management.

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/fintech-blockchain-global-market-report

Scope Of FinTech Blockchain Market

The Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

FinTech Blockchain Market Overview

Market Drivers –

The broader adoption of cryptocurrencies is expected to propel the growth of the fintech blockchain market going forward. Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology. The adoption of cryptocurrencies is due to enhanced security features, lower transaction costs, faster transaction times, and the growing desire for financial privacy and control. Blockchain technology revolutionizes fintech by providing secure, transparent, decentralized platforms for cryptocurrencies, enabling efficient and cost-effective financial transactions and services. For instance, in January 2024, according to Security.org, a US-based company dedicated to providing free and open access to information and resources, cryptocurrency awareness and ownership increased, with 40% of American adults now holding digital assets, a growth from 30% in 2023, representing up to 93 million individuals. Therefore, the broader adoption of cryptocurrencies is driving the fintech blockchain market.

Market Trends –

Major companies operating in the fintech blockchain market are focusing on developing advanced solutions, such as blockchain-based motor insurance platforms, to enhance transaction security, streamline processes, and increase transparency across financial operations. Blockchain-based motor insurance platforms help reduce fraud, ensure data integrity, automate transactions, and improve financial operations’ efficiency. In September 2022, XA Group, a Dubai-based company that develops advanced automotive solutions, including blockchain-based digital platforms, launched Addenda, a blockchain-based digital platform designed to streamline and modernize the reconciliation of motor recovery receivables between insurers. This platform aims to resolve longstanding challenges in the insurance industry caused by decentralized and paper-based processes. Addenda facilitates centralized communication and management of motor claims recovery, involving insurers, brokers, repairers, and customers, and has been joined by several major UAE-based insurers.

The fintech blockchain market covered in this report is segmented –

1) By Provider: Application And Solution Providers, Middleware Providers, Infrastructure And Protocols Providers

2) By Organization Size: Small And Medium-Sized Enterprises (SMEs), Large Enterprises

3) By Application: Payments, Clearing, And Settlement, Exchanges And Remittance, Smart Contracts, Identity Management, Compliance Management Or Know Your Customer (KYC), Other Applications

4) By Industry Vertical: Banking, Non-Banking Financial Services, Insurance

Get an inside scoop of the fintech blockchain market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=16425&type=smp

Regional Insights –

Asia-Pacific was the largest region in the fintech blockchain market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the fintech blockchain market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies –

Major companies operating in the fintech blockchain market are <b>Microsoft Corporation, Amazon Web Service Inc., International Business Machines Corporation (IBM), Oracle Corporation, Binance Holdings Limited, Coinbase Global Inc., Ripple Labs Inc., Payward Inc., Celsius Network Limited, eToro Group Limited, Gemini Trust Company LLC, Huobi Global Limited, Chainalysis Inc., Circle Internet Financial Limited, ConsenSys Inc., Paxos Trust Company LLC, Bitstamp Ltd., Bitfury Group Limited, Ledger SAS, Earthport Plc, Digital Asset Holdings LLC, BitPay Inc., BlockFi Inc., BTL Group, Factom Inc.</b>

Table of Contents

1. Executive Summary

2. FinTech Blockchain Market Report Structure

3. FinTech Blockchain Market Trends And Strategies

4. FinTech Blockchain Market – Macro Economic Scenario

5. FinTech Blockchain Market Size And Growth

…..

27. FinTech Blockchain Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model