FinTech Blockchain Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “FinTech Blockchain Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the FinTech Blockchain market, with forecasts outspreading to the year 2030.

Curious to peek inside? Grab your sample copy of this report now:https://www.maximizemarketresearch.com/request-sample/13770/

Estimated Growth Rate for FinTech Blockchain Market

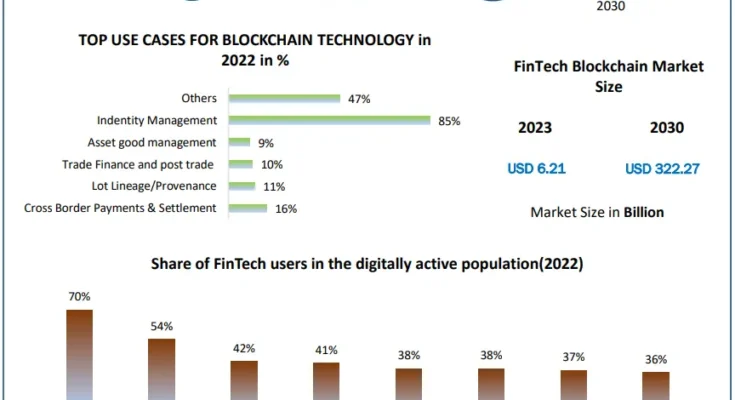

The FinTech Blockchain Market is projected to grow at a compound annual growth rate (CAGR) of 75.80% from its 2023 valuation of USD 6.21 billion to USD 322.27 billion by 2030.

FinTech Blockchain Market Scope and Methodology:

The method used in the report to give investors relevant information is a combination of descriptive analysis and SWOT analysis. Presenting a comprehensive image of the FinTech Blockchain market is the study’s main objective. The data collection process makes use of a variety of methods, such as questionnaires and surveys. Mathematical, statistical, and numerical techniques are then used to evaluate the data. Compiling and arranging data is crucial since identifying FinTech Blockchain market trends requires the application of both qualitative and quantitative research techniques.

By carefully examining the buyer-direct scenario, R&D projects, innovative forms of development, cutting-edge industry practices, and market consolidations and acquisitions, the research evaluates the potential futures of the market. The research includes charts, organizational portfolios, methods, and a critical evaluation of well-known corporate CEOs. FinTech Blockchain To determine market trends and provide microeconomic variables, the market conducted a thorough SWOT and PESTLE analysis.

Eager to discover what’s within? Secure your sample copy of the report today:https://www.maximizemarketresearch.com/request-sample/13770/

FinTech Blockchain Market Regional Insights

The evaluation of the market’s prospective futures involves a thorough examination of various factors, including the buyer-direct scenario, R&D initiatives, creative forms of development, cutting-edge industry practices, and market consolidations and acquisitions. The study includes methods, organizational charts, portfolios, and a critical assessment of prominent business executives. FinTech Blockchain Market conducted a comprehensive SWOT and PESTLE analysis to identify market trends and offer microeconomic variables.

FinTech Blockchain Market Segmentation

by Application

Payments, clearing, and settlement

Exchanges and remittance

Smart contracts

Identity management

Compliance management/Know Your Customer (KYC)

Others (cyber liability and content storage management

by Provider

Application and solution providers

Middleware providers

Infrastructure and protocols providers

by Organization Size

Small and Medium-Sized Enterprises (SMEs)

Large enterprises

by Industry Vertical

Banking

Non-banking financial services

Insurance

Table of Content: FinTech Blockchain Market

Part 01: Executive Summary

Part 02: Scope of the FinTech Blockchain Market Report

Part 03: Global FinTech Blockchain Market Landscape

Part 04: Global FinTech Blockchain Market Sizing

Part 05: Global FinTech Blockchain Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Intrigued to explore the contents? Secure your hands-on sample copy of the report:https://www.maximizemarketresearch.com/request-sample/13770/

FinTech Blockchain Market Key Players

North America:

1. Ripple Labs Inc. (San Francisco, California, USA)

2. Coinbase (San Francisco, California, USA)

3. Gemini Trust Company (New York, New York, USA)

4. Chain Inc. (San Francisco, California, USA)

5. Digital Asset Holdings (New York, New York, USA)

6. Circle Internet Financial (Boston, Massachusetts, USA)

7. Consensys (Brooklyn, New York, USA)

8. BitPay (Atlanta, Georgia, USA)

9. Corda (R3) (New York, New York, USA)

10. Kraken (San Francisco, California, USA)

Europe:

11. Adyen (Amsterdam, Netherlands)

12. Wirex (London, United Kingdom)

13. Bitstamp (Luxembourg)

14. Revolut (London, United Kingdom)

15. Blockchain.com (London, United Kingdom)

16. eToro (London, United Kingdom)

17. Santander InnoVentures London, United Kingdom

18. Fidor Bank (Munich, Germany)

19. SolarisBank (Berlin, Germany)

20. Binance (Valletta, Malta)

Asia Pacific:

21. Ant Group (Hangzhou, Zhejiang, China)

22. Binance Asia Services Pte Ltd (Singapore)

23. Coinone (Seoul, South Korea)

24. QUOINE (Tokyo, Japan)

25. Huobi Global (Singapore)

26. ZebPay (Singapore)

27. OKCoin (Hong Kong)

28. Coins.ph (Manila, Philippines)

29. Liquid (Quoine) (Tokyo, Japan)

30. Korbit (Seoul, South Korea)

For deeper market insights, peruse the summary of the research report:https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

Key questions answered in the FinTech Blockchain Market are:

- What is FinTech Blockchain ?

- What is the growth rate of the FinTech Blockchain Market?

- What was the FinTech Blockchain Market size in 2023?

- What are the upcoming opportunities and trends for the FinTech Blockchain Market?

- What are the different segments of the FinTech Blockchain Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the FinTech Blockchain Market?

- What segments are covered in the FinTech Blockchain Market?

- Which are the factors expected to drive the FinTech Blockchain Market growth?

- What growth strategies are the players considering to increase their presence in FinTech Blockchain ?

- Who are the leading companies and what are their portfolios in FinTech Blockchain Market?

- Who are the key players in the FinTech Blockchain market?

- What is the CAGR at which the FinTech Blockchain market will grow during the forecast period?

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2023)

- Past Pricing and price curve by region (2018 to 2023)

- Market Size, Share, Size & Forecast by different segment | 2024−2030

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656

Latest cutting-edge research from Maximize Market Research is now trending:

Global Flight Navigation System Market https://www.maximizemarketresearch.com/market-report/global-flight-navigation-system-market/116707/

Global Hybrid Train Market https://www.maximizemarketresearch.com/market-report/global-hybrid-train-market/92996/