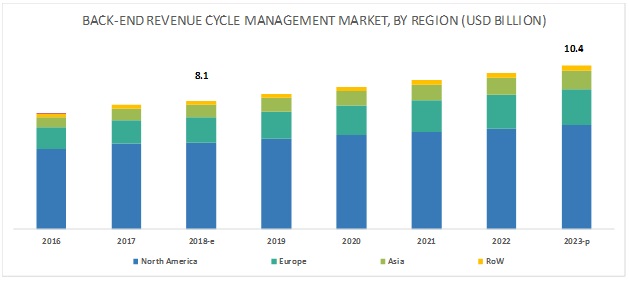

The report “Back-End Revenue Cycle Management Market by Product and Services (Claim Processing, Denial Management, Payment Integrity), Delivery Mode (On-Premise, Cloud Based), End-User (Payer, Provider (Inpatient, Outpatient)), and Region – Global Forecast”, the Back-End RCM Market is projected to reach USD 10.4 billion by 2023 from USD 8.1 billion in 2018, at a CAGR of 5.0%.

Growing importance of denials management;

To reduce costs and maximize profits, insurance companies are increasingly denying claims as well as coverage to patients being treated for chronic or persistent illnesses. This is putting an extra burden on healthcare providers to manage operating costs, and in turn is supporting the adoption of back-end revenue cycle management solutions (with a growing number of healthcare providers focusing on properly analyzing denied claims and appealing them).

Many healthcare providers across the globe still use manual and paper-oriented approaches to manage denials. This results in errors, delayed follow-ups, and miscommunication between healthcare providers and insurance companies. The use of back-end revenue cycle management solutions over manual and paper-oriented approaches can not only help healthcare providers overcome these issues but also help them save significant costs. As a result, the demand for back-end revenue cycle management solutions is expected to increase among end users during the forecast period.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=204439794

Leading Key Players and Analysis:

Athenahealth (US), Cerner Corporation (US), Allscripts Healthcare Solutions, Inc. (US), eClinicalWorks (US), Optum, Inc. (US), McKesson Corporation (US), Conifer Health Solutions (US), GeBBs Healthcare Solutions (US), The SSI Group (US), GE Healthcare (US), nThrive (US), DST Systems (US), Cognizant Technology Solutions (US), and Quest Diagnostics (US) are the key players in the Back-End RCM Market.

Cerner has a strong foothold in the back-end revenue cycle management market. The company caters to the healthcare technology and financial management needs of its global customers. Cerner focuses on research and development activities, deploying products, and acquisitions to enhance its market presence. For instance, in the past three years, the company deployed more than 15 back-end revenue cycle management solutions across various hospitals, care centers, and medical centers. The acquisition of Siemens Health Services in January 2015 further strengthened its back-end revenue cycle management portfolio.

Geographical Analysis in Detailed?

The back-end revenue cycle management market is divided into North America, Europe, Asia, and the Rest of the World (RoW). North America is expected to account for the largest share in 2018 owing to factors such as growing HCIT investments in the region and the presence of regulatory mandates. North America is followed by Europe and Asia. The market in Asia is relatively nascent; however, it is projected to be the fastest-growing market during the forecast period.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=204439794

Industry Segmentation:

The Services segment to dominate the back-end revenue cycle management market.

By product & service, segmented into software and services. The services segment is expected to account for the largest share of the Back-End RCM Market in 2018. The large share of this segment can be attributed to the recurring nature of services such as training and development, installation, software upgrades, consulting, and maintenance. However, due to the need for periodic software upgrades, the software segment is expected to witness the highest growth during the forecast period.

The cloud-based systems to register the highest CAGR during the forecast period

On the basis of delivery mode, segmented into on-premise and cloud-based systems. The cloud-based segment is expected to register the highest CAGR of the back-end revenue cycle management market during the forecast period. Growth in this segment can be attributed to the comparatively lower capital expenses and operational costs incurred in this model, alongside its scalability, flexibility, and affordability.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=204439794