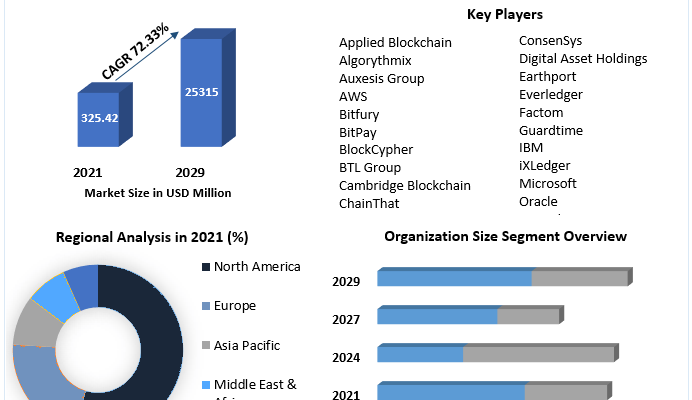

Global Blockchain Insurance Market was valued at USD 325.42 Million in 2021, and it is expected to reach USD 25315.55 Million by 2029, exhibiting a CAGR of 72.33% during the forecast period (2022-2029)

Blockchain Insurance Market Overview:

The Maximize Market Research report analyses the global Blockchain Insurance market in depth, precisely, and comprehensively, with a focus on market dynamics, market competition, regional growth, segment analysis, and important growth strategies. The analysis contains information on market growth as well as market segmentation like regions, product type, application, and end-use industry. Analyst creates comprehensive and precise marketing research reports using the most up-to-date Blockchain Insurance Market research techniques and technology. This analysis covers a wide range of industry verticals along with a thorough examination of the Blockchain Insurance market size and share.

Market Scope:

The report goes over demand estimates, market trends, and micro and macro variables in great detail. This study also highlights the elements that are driving and impeding the market’s growth. The MMR Matrix in the study gives information on prospective investment opportunities to both existing and new market participants. To provide market insights, the research use analytical approaches such as Porter’s five forces analysis and PESTLE of the Blockchain Insurance market. The research also looks at current market trends and forecasts for the years 2022-2029. The study also uncovered important impending advancements that would have an impact on demand over the anticipated timeframe.

Request for free broacher:https://www.maximizemarketresearch.com/request-sample/11489

Segmentation:

The application and solution provider segment is anticipated to be the leading end-user segment over the projection period based on Provider. Blockchain technology uses a platform that is spread out over a company’s network and records business transactions indeliblely. By decentralising credential ownership, blockchain technology makes it possible to implement a universal method for authenticating users’ records in an immutable data chain. The digital economy could undergo a transformation thanks to blockchain technology, which could have disruptive effects.

Key Players:

To identify the market’s leaders and predict market revenue, both primary and secondary research are performed. CEOs, marketing executives, and seasoned front-line employees are just a few of the influential thought leaders and subject matter experts who are included in the main study’s in-depth interviews. As part of the primary research, extensive interviews with important thought leaders and business professionals, such as CEOs, marketing executives, and seasoned front-line staff, were conducted. As part of the secondary research, a review of the annual and financial reports of the major manufacturers was also done. Secondary data is employed to calculate percentage splits, market shares, growth rates, and global market breakdowns. The results of these calculations are then compared to primary data.

- • Ziglu Limited (US)

• Circle Internet Financial Limited (US)

• ConsenSys (US)

• Digital Asset Holdings (US)

• Symbiont (US)

• AlphaPoint (US)

• AWS (US)

• BitPay (US)

• BlockCypher (US)

• BTL Group (US)

• IBM Technology (US)

• Microsoft (US)

• Oracle (US)

• BTL Group (Canada)

• ChainThat Limited (UK)

• Applied Blockchain (UK)

• Everledger (UK)

• Bitfury (Netherlands)

• Lykke AG (Switzerland)

• Guardtime (Switzerland)

• SAP SE (Germany)

• Horizon state Pty Ltd. (Australia)

• Auxesis Group (India)

• Algorythmix (India)

• L&T Finance Holdings Linited (India)

• Tata Group (India)

Browse Related Report:https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/

Regional Analysis:

The regional overview of market research for Blockchain Insurance also discusses key market-influencing elements and legal developments that have an impact on current and future market trends. Current and upcoming trends are investigated in order to evaluate the whole market potential and find lucrative patterns in order to establish a better footing. The basis for evaluating the regional market is the current environment and expected trends.

COVID-19 Impact Analysis on Blockchain Insurance Market:

Owing to a halt in operations, the growth of end-user industries using Blockchain Insurance decreased from January 2020 to May 2020. These countries included Spain, France, Italy, China, the United States, the United Kingdom, and Spain. As a result, the market for Blockchain Insurance manufacturers as well as the profits of companies operating in these industries both experienced a sharp decline. This had an impact on the market’s expansion in 2020. Due to lockdowns and an increase in COVID-19 occurrences globally, end-user business need for Blockchain Insurance has been severely decreased.

Key Questions Answered in the Blockchain Insurance Market Report are:

- Which market segment accounted for the most percentage of Blockchain Insurance in 2021?

- How competitive is the market environment?

- What are the primary factors influencing the Blockchain Insurance market’s growth?

- Which region dominates the Blockchain Insurance market in terms of market share?

- What is the expected market CAGR from 2022 to 2029?

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Bangalore Highway,

Narhe, Pune, Maharashtra 411041, India.

Email: sales@maximizemarketresearch.com

Website: www.maximizemarketresearch.com

Blockchain Insurance Market Share Insights | Global Demand & Trends analysis | Forecast 2029