Cyber Security Insurance Market Overview:

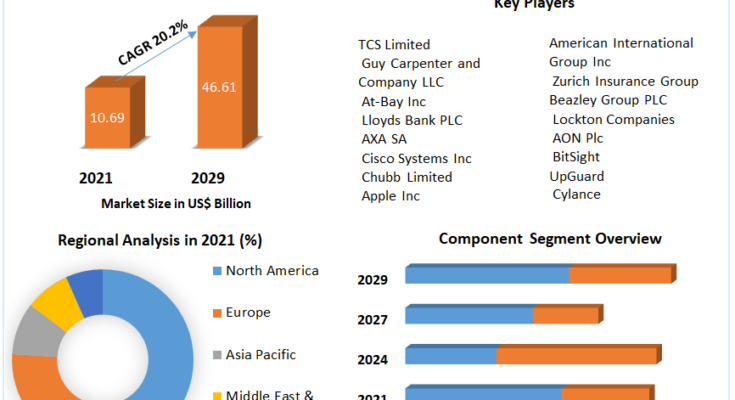

As per Maximize Market Research, a global business research and consultancy firm, the total global market for “Cyber Security Insurance Market” was valued at US$ 10.69 Bn. in 2021 and expected to grow at a CAGR of 20.2% during the forecast period (2021-2029).

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/31797

Cyber Security Insurance Market Dynamics:

The two main reasons propelling the expansion of the global market are growing digitalization and rising internet-connected device usage. By 2022, more than 29 billion devices are anticipated to connect to the internet. Due to the current global pandemic, there are more employees working in remote locations with insecure networks, weak passwords, and the use of personal devices, among other risk factors. This may increase interest in the market for cyber security insurance.

Cyber Security Insurance Market Segmentation:

by Component

• Solution

• Service

The Cyber Security Insurance market is further divided into solution and service categories based on component. The solution sector, which maintained a share of 62% in 2021, dominated the global market. The growth of the solution segment is being influenced by factors such as the expansion of corporate organisations, the installation of cyber security software, and the requirement for a security operation centre. The solution segment offers extensive coverage, expert access, patch management, endpoint security response, vulnerability monitoring, and alert system, as well as local data storage and backup and two-factor authentication. These attributes have led to a healthy market growth for the solution segment.

by Organization size

• Large organizations

• SMEs

The Cyber Security Insurance market is divided into major organisations and SMEs based on Organisation Size. The big organisation sector, which was valued at US$ 4.3 billion in 2021, dominates the global market. The causes that draw the rise of cyber insurance in major organisations are the need to safeguard businesses from data breaches, the risk of losing customers’ trust, the need to protect sensitive information, the expense of a security breach, etc.

by Coverage type

• First-Party coverage

• Third-Party coverage

The cyber security insurance industry is divided into first-party coverage and third-party coverage based on coverage. The market is dominated by first party coverage, which had a 50% share in 2021. because it pays for the costs associated with data theft and system or network breaches. This section discusses payments made in response to online extortion, contacting clients who have been impacted, crisis management, and fraud monitoring services. These are the characteristics driving the market’s expansion of the first-party coverage segment. Only legal defence costs, court fines due after a data breach, and other court fees are covered by the third-party component. These issues are causing the third party segment’s market growth to slow down.

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/31797

Cyber Security Insurance Market Scope and Methodology

The primary source involved interviews with significant market leaders and industry experts including business owners and marketing specialists while secondary sources are a combination of the reviews of the financial and annual reports of top manufacturers. For better information on market penetration, competitive landscape demand analysis, and regional analysis are taken at the local, regional, and global levels. The report analyses an estimation of the market size of the Cyber Security Insurance market along with current as well as future trends. The report provides an in-depth analysis of the key development, marketing strategies, supply side and demand side indicators and company profiles of the market owners, market leaders, potential players and new entrants. The bottom-up approach was used in the report to estimate the Cyber Security Insurance Market. The primary and secondary data sources were used to collect data.

Cyber Security Insurance Market Key Players:

• TCS Limited

• Guy Carpenter and Company LLC

• At-Bay Inc

• Lloyds Bank PLC

• AXA SA

• Cisco Systems Inc

• Chubb Limited

• Apple Inc

• American International Group Inc

• Zurich Insurance Group

• Beazley Group PLC

• Lockton Companies

• AON Plc

• BitSight

• UpGuard

• Cylance

For any Queries Linked with the Report, Ask an Analyst@ https://www.maximizemarketresearch.com/market-report/global-cyber-security-insurance-market/31797/

Cyber Security Insurance Market Regional Insights:

The Cyber Security Insurance market demonstrates extensive segmentation across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. The report offers a comprehensive evaluation of various aspects, encompassing factors, market dimensions, growth pace, and regional import-export dynamics. This analysis delves into both local and country levels within each region.

Key questions answered in the Cyber Security Insurance Market are:

- What is Cyber Security Insurance?

- What was the Cyber Security Insurance market size in 2022?

- What are the different segments of the Cyber Security Insurance Market?

- What growth strategies are the players considering to increase their presence in Cyber Security Insurance?

- What are the upcoming industry applications and trends for the Cyber Security Insurance Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Cyber Security Insurance Market?

- Who are the key players in the Cyber Security Insurance market?

- What segments are covered in the Cyber Security Insurance Market?

- Who are the leading companies and what are their portfolios in Cyber Security Insurance Market?

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2021)

- Past Pricing and price curve by region (2018 to 2021)

- Market Size, Share, Size & Forecast by different segment | 2023−2029

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Our Address

- MAXIMIZE MARKET RESEARCH PVT. LTD.

- ⮝ 444 West Lake Street, Floor 17,

- Chicago, IL, 60606, USA.

- ✆ +1 800 507 4489

- ✆ +91 9607365656

- 🖂 [email protected]

- www.maximizemarketresearch.com