Client/server architecture is the standard foundation for desktop virtualization, in which the organization’s preferred operating system and applications operate on a server housed either in a data center or in the cloud. This architecture is reminiscent of the so-called “dumb” terminals that were common on mainframes and early Unix systems, where all user interactions take place on a local device of the user’s choosing.

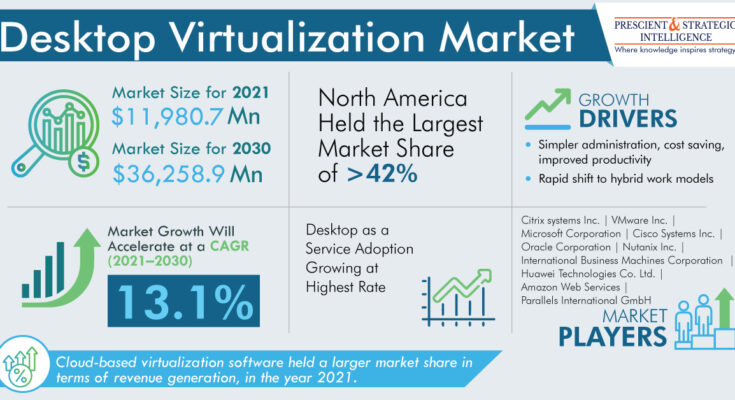

Moreover, in comparison to traditional desktop computers, it has several benefits, including easier administration, lower costs, more productivity, support for a wide range of kinds of devices, agility and scalability, stronger security, and better operator experiences. The desktop virtualization market is on the track to hit $36,258.9 million by 2030, growing at a 13.1% CAGR from 2021 to 2030.

The cloud-based category held a larger market share in terms of revenue generation, in the year 2021. Through the internet, cloud-based computing provides access to software that is using shared resources including processing power, disc storage, and memory. These computer resources are maintained by remote data centers, which were designed specifically to host programs on various platforms.

North America holds the largest share in the global desktop virtualization market. This is mostly credited to the region’s advanced IT infrastructure, which was made possible by significant IT investment, adoption of 5G technology, and early adoption of cloud-based technologies. This technology is widely used at universities, colleges, and K–12 district schools, which explains why there is a high requirement for virtual desktop software in this area than elsewhere.

Types of Desktop Virtualization

In the desktop virtualization market, the three most common types of desktop virtualization: Remote desktop services (RDS), Desktop-as-a-Service (DaaS), and Virtual desktop infrastructure (VDI).

• By giving service providers the role and responsibility for desktop virtualization, DaaS significantly decreases the strain on the IT department. The predictable monthly prices that DaaS providers build their business model on will be appreciated by organizations that desire to convert IT spending from capital expenses to operational expenses.

The growing need for secure virtual desktops when working remotely, especially now that the epidemic has prompted companies to adopt hybrid work practices. This is why, DaaS generated about 25.0% of the desktop virtualization market revenue in past, and it will grow CAGR of 13.5% during the forecast period.

• VDI replicates the well-known desktop computing concept and operates on VMs in either an on-premises data center or the cloud. Adopting this strategy allows businesses to administer the desktop virtualization server just like any other on-premises application server.

• RDS is frequently used in place of a full Windows or Linux desktop when only a small number of applications need to be virtualized. Applications are broadcast to the local device, which has its own OS, in this manner. Because only applications are virtualized, RDS systems may provide a greater user density per VM.

Several big companies in the desktop virtualization software market are continuously busy with innovations of products and enhancing their customer base and position. These companies are Parallels International GmbH, Amazon Web Services, Citrix systems Inc., Microsoft Corporation, Nutanix Inc., Huawei Technologies Co. Ltd., Cisco Systems Inc., Oracle Corporation, International Business Machines Corporation, and VMware Inc.