Introduction: Digital Payment Market Reaches New Heights in 2024

The Global Digital Payment Market continues to witness remarkable growth, with an increasing number of consumers and businesses adopting digital payment methods globally. As of 2024, the market is projected to reach significant milestones, driven by innovations in payment technologies, strategic mergers and acquisitions, and growing adoption across emerging economies.

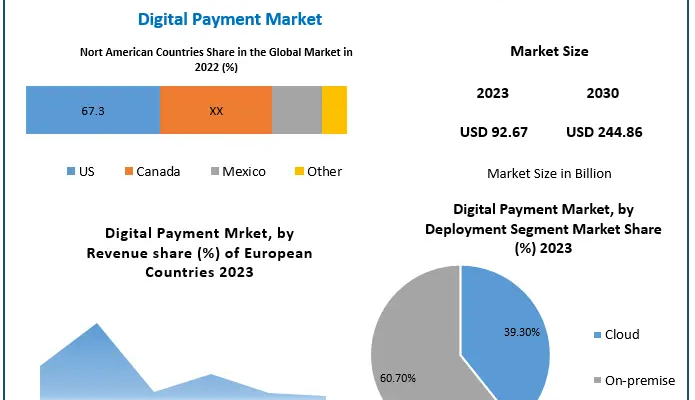

The size of the digital payment market was estimated at USD 92.67 billion in 2023, and it is anticipated that total income from digital payments will increase at a compound annual growth rate (CAGR) of 14.89% between 2024 and 2030, reaching around USD 244.86 billion.

Intrigued to explore the contents? Secure your hands-on sample copy of the report: https://www.maximizemarketresearch.com/request-sample/16835/

Key Drivers Behind the Surge in the Digital Payment Market

- Technological Innovations: Advancements in mobile wallets, AI, blockchain, and contactless payments are leading the way in transforming global payment systems.

- Increased Consumer Adoption: The growing preference for cashless transactions, especially in e-commerce, retail, and service sectors, is propelling market growth.

- Government Initiatives: Several countries are promoting digital payment ecosystems through regulatory changes and infrastructure investments to ensure more inclusive and accessible payment solutions.

Mergers and Acquisitions: Strategic Movements in the Digital Payment Sector

Several key mergers and acquisitions in the digital payment market are reshaping the competitive landscape:

- Major Acquisitions in North America:

- Square and Afterpay Merger: In 2024, Square’s acquisition of Afterpay strengthened its position in the global digital payment market, expanding its buy-now-pay-later services.

- PayPal’s Strategic Acquisitions: PayPal continues to bolster its payment infrastructure with key acquisitions in the mobile payment space, aiming for more seamless global transactions.

- Mergers in Asia-Pacific:

- Ant Financial’s Acquisition of Paytm: Ant Financial’s strategic investment in Paytm (India) is strengthening its footprint in Asia, expanding access to digital payments and mobile wallets in India and Southeast Asia.

- Samsung Pay’s Partnership with Stripe: Samsung Pay is teaming up with Stripe to enhance payment processing across its mobile and smartwatch platforms in Southeast Asia.

Eager to discover what’s within? Secure your sample copy of the report today:https://www.maximizemarketresearch.com/request-sample/16835/

Regional Market Trends and Developments

Vietnam & Thailand:

Both Vietnam and Thailand have seen rapid growth in digital payment systems. Vietnam’s young, tech-savvy population and increasing smartphone penetration have contributed to the rise of mobile payment solutions like MoMo and ZaloPay. Thailand’s “PromptPay” system has become a critical part of the government’s drive for digital payments, pushing towards a cashless society by 2025.

Japan and South Korea:

Japan and South Korea have long been pioneers in digital payment innovations. In Japan, digital payment services such as Rakuten Pay are expanding, while South Korea’s market continues to grow rapidly with KakaoPay and Naver Pay leading the charge. Both countries have seen growing investments in AI-powered payment systems and biometrics for secure transactions.

United States:

The U.S. continues to be a dominant player in the digital payment market, with companies like PayPal, Apple Pay, and Google Pay leading the charge. In 2024, the U.S. market is witnessing an increased shift towards contactless and mobile wallet payments, with an uptick in e-commerce-driven transactions.

Inquire for More Details:https://www.maximizemarketresearch.com/request-sample/16835/

Segmentation:

by Component

Solution

Service

by Deployment

Cloud

On-premise

The market was dominated by the on-premise category in 2023, which generated over 65.0% of worldwide revenue. On-premises digital payment solutions allow companies total control over their systems and applications, which their IT staff can readily manage. On-premise digital payment solutions are also used by businesses to defend their systems and applications against dangerous attacks. For instance, in November 2019, Microsoft announced a collaboration with ACI Global. Benefits of the partnership for ACI World Wide’s on-premises clients included increased security and decreased long-term capital expenditure.

by Vertical

BFSI

Media & Entertainment

IT & Telecommunication

Hospitality

Healthcare

With over 23.1 percent of global sales in 2023, the BFSI sector led the market. Increased remittances to low- and middle-income countries are anticipated to be one of the main drivers of new market growth opportunities over the projected period. Additionally, banks are improving their ability to compete with companies like Google, Amazon, and Facebook that offer digital payment solutions. To make things easier for its customers, Bank of America, for instance, introduced a digital debit card in June 2019.

Want a comprehensive market analysis? Check out the summary of the research report:https://www.maximizemarketresearch.com/market-report/digital-payment-market/16835/

Key Players:

- PayPal: As one of the world’s most significant digital payment providers, PayPal is innovating in mobile payment solutions, cryptocurrency, and cross-border transactions.

- Square: Known for its point-of-sale systems, Square has expanded into e-commerce payment solutions and buy-now-pay-later services through its acquisition of Afterpay.

- Visa & Mastercard: These two giants are continuously improving payment security technologies, including AI-driven fraud detection, to enhance consumer confidence in digital transactions.

- Ant Financial (Alipay): Ant Financial remains a dominant player in the digital payments space, particularly in Asia, with its comprehensive ecosystem that includes everything from mobile wallets to micro-lending.

- Adyen: This global payment company offers seamless payment solutions across borders, particularly to e-commerce companies, making it a critical player in international digital payments.

North America:

1. Total System Services, Inc.

2. PayPal Holdings Inc

3. ACI Worldwide Inc

4. Dwolla

5. FattMerchant

6. FIS and Fiserv

7. Intuit

8. JPMorgan Chase

9. Square

10. Stripe

11. Visa and Mastercard

Europe:

1. Wirecard AG.

2. Novetti Group Limited

3. Adyen N.V.

4. Aurus

5. Worldline

6. Checkout

Asia Pacific:

1. Lianta Payments

2. Alipay

3. PayU

Global:

1. Apple Pay

2. Paysafe

3. PayTrace

4. Spreedly

5. WEX

Future Outlook for the Digital Payment Market

The digital payment market is evolving rapidly, driven by technological advancements, strategic partnerships, and the increasing preference for cashless transactions. As the market continues to grow across regions, companies that focus on innovation, security, and seamless integration will remain at the forefront. Expect major shifts in how businesses and consumers interact with money and payments, especially with growing trends like AI-powered services, blockchain, and cross-border digital payment platforms.

Discover What’s Trending:

Network Infrastructure Market https://www.maximizemarketresearch.com/market-report/global-network-infrastructure-market/23874/

Jute Bags Market https://www.maximizemarketresearch.com/market-report/jute-bags-market/146633/

About Maximize Market Research :

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research :

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656

Racing Drone Market to Reach USD 3.65 Billion by 2030, Growing at 22.1% CAGR