The earthquake insurance global market report 2024from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Earthquake Insurance Market, 2024The earthquake insurance global market report 2024

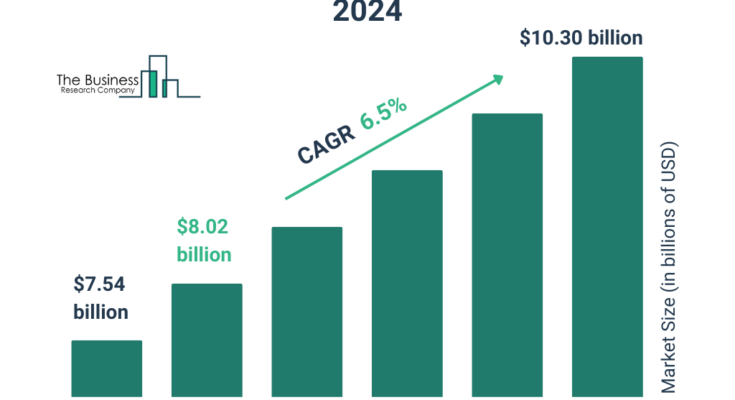

Market Size – The earthquake insurance market size has grown strongly in recent years. It will grow from $7.54 billion in 2023 to $8.02 billion in 2024 at a compound annual growth rate (CAGR) of 6.3%. The growth in the historic period can be attributed to increasing natural disasters, government initiatives and regulations, rapid global urbanization, growing demand for insuring older buildings, and increasing trend of home insurance policies.

The earthquake insurance market size is expected to see strong growth in the next few years. It will grow to $10.30 billion in 2028 at a compound annual growth rate (CAGR) of 6.5%. The growth in the forecast period can be attributed to rise in the adoption of insurance policies due to future uncertainties, growing construction activity, increasing natural disasters, rising awareness of the need for earthquake insurance, and rising levels of infrastructure development. Major trends in the forecast period include growing installations of earthquake warning systems, the introduction of new technology such as internet of things (IoT)-based systems and data analytics, the introduction of innovative and tailored risk products, advances in risk modeling methodologies, and product innovations.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/earthquake-insurance-global-market-report

Scope Of Earthquake Insurance MarketThe Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6.Macro Economic Factors: Assessment of broader economic elements impacting the market.

Earthquake Insurance Market Overview

Market Drivers -The increasing occurrence of natural disasters is propelling the growth of the earthquake insurance market. Natural disasters, such as earthquakes, cause significant loss of life, property damage, and environmental destruction, with factors like rising temperatures, intense storms, and urbanization contributing to this rise. Earthquake insurance helps individuals and businesses recover from these catastrophes by covering repair costs for homes and buildings, thus providing financial stability. In March 2023, ReliefWeb reported 387 documented natural hazards and disasters globally, surpassing the 2002–2021 average of 370.

Market Trends – Major companies operating in the earthquake insurance market focus on developing innovative insurance policies, such as natural catastrophe (Nat cat) insurance, to provide quicker and more efficient payouts following natural disasters. NormanMax Syndicate 3939 is the pioneering syndicate specializing in natural catastrophe parametric re/insurance products for hurricanes, tropical cyclones, typhoons, and earthquakes. For instance, in May 2024, NormanMax Insurance Holdings, a US-based insurance company, launched Syndicate 3939. These innovative parametric products offer transparent and rapid payouts, bridging critical insurance gaps. They can be distributed efficiently and at scale, addressing issues of trapped capital. This syndicate is noteworthy as it is the first of its kind at Lloyd’s. It specifically focused on natural catastrophe parametric insurance products, including hurricane coverage, tropical cyclones, typhoons, and earthquakes.

The earthquake insurance market covered in this report is segmented –

1) By Type: Life Insurance, Non-Life Insurance

2) By Coverage Type: Comprehensive, Catastrophic

3) By Distribution Channel: Banks, Agents, Brokers, Retailers, Other Distribution Channels

4) By Application: Personal, Commercial

5) By End-User: Individuals, Business

Get an inside scoop of the earthquake insurance market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=18580&type=smp

Regional Insights – North America was the largest region in the earthquake insurance market in 2023. The regions covered in the earthquake insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies – Major companies in the market are Berkshire Hathaway Inc., State Farm Insurance, Nationwide Mutual Insurance Company, Allstate Corporation, Liberty Mutual Insurance Company, Zurich Insurance Group Ltd., Chubb Limited, The United Services Automobile Association (USAA), Mapfre S.A., The Hartford Financial Services Group Inc., American Family Mutual Insurance Company S.I., Farmers Insurance Group, Assurant Inc., Cincinnati Financial Corporation, Mercury General Corporation, Amica Mutual Insurance Company, CW Group Holdings Inc., The Earthquake Commission (EQC), GeoVera Holdings Inc., The California Earthquake Authority

Table of Contents

1. Executive Summary

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model