Global Ethoxylates Market has valued at USD 12.86 billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 3.64% through 2028. Ethoxylates are organic chemical compounds that are produced through the chemical treatment of alcohols and phenols with ethylene oxide in the presence of potassium hydroxide. This process results in the formation of versatile intermediates that find application in a wide range of industries. Due to their high-water solubility, excellent wetting ability, good formulation properties, and low aquatic toxicity, ethoxylates are extensively used in various industrial applications. For instance, they serve as effective emulsion stabilizers during the processing of emulsion polymers.

Their unique combination of hydrophobic and hydrophilic properties allows ethoxylates to lower the surface tension between liquids and gases, facilitating better interaction and performance. The ethoxylates market is driven by several factors. The agrochemical industry’s rising demand for ethoxylates, coupled with its growth and expansion, plays a significant role in fueling the market’s growth rate. Additionally, the industrial and institutional cleaning industry exhibits high demand for ethoxylates, further propelling market value. The increasing industrialization and the growing preference for low-rinse detergents also contribute to the growth rate of the ethoxylates market. Furthermore, the changing lifestyle of consumers, coupled with an increase in disposable income, indirectly influences market growth.

Moreover, the expansion of household and agricultural industries, particularly in developing economies, paves the way for a smooth and steady growth trajectory. However, the growth of the ethoxylates market faces challenges due to health hazards associated with exposed ethoxylates and rising environmental concerns regarding their toxicity. Additionally, fluctuations or volatility in the prices of raw materials, such as crude oil, can dampen the growth rate of the ethoxylates market. These factors collectively shape the dynamics of the ethoxylates market, with opportunities for growth and challenges that need to be addressed to ensure sustainable progress in the industry.

Key Market Drivers

Growing Demand of Ethoxylates in Pharmaceutical Industry

Ethoxylates, with their surfactant properties and ability to enhance solubility and stability, play a crucial role in pharmaceutical formulations. These versatile compounds find extensive usage in the production of various drugs, serving different purposes. In the pharmaceutical industry, emulsifying agents are essential for formulating creams, ointments, and lotions. Ethoxylates, with their excellent emulsification properties, are widely employed in the production of stable emulsions, facilitating the controlled release of active pharmaceutical ingredients, and improving the effectiveness and patient experience. Moreover, ethoxylates act as effective solubilizing agents, addressing the low solubility of many drug compounds. This property enables better dispersion of hydrophobic drugs in aqueous solutions, enhancing their solubility, absorption, and therapeutic efficacy.

Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=2450

In the pharmaceutical manufacturing process, wetting agents are crucial for ensuring uniform spreading and maximum contact with solid particles. Ethoxylates, known for their wetting properties, are extensively utilized in tablet coatings, granulation processes, and other pharmaceutical applications. Cleanliness and sterility are paramount in the pharmaceutical industry. Ethoxylates serve as versatile cleaning agents, thanks to their excellent detergent properties. They play a vital role in removing contaminants and residues from manufacturing equipment, contributing to the production of high-quality pharmaceutical products. As pharmaceutical companies increasingly prioritize patient-centric approaches, ethoxylates enable the formulation of drugs with improved bioavailability, controlled release, and better sensory attributes. These properties not only enhance patient compliance but also contribute to overall patient satisfaction. In summary, ethoxylates are indispensable in pharmaceutical formulations. Their surfactant properties, ability to enhance solubility and stability, and diverse applications make them valuable components in the production of various drugs. From facilitating controlled release and improving drug efficacy to enabling better solubility and enhancing patient experience, ethoxylates continue to drive advancements in the pharmaceutical industry.

Increasing Awareness of Personal Hygiene

Personal hygiene and cleanliness play a vital role in maintaining overall health and well-being. Ethoxylates, which function as surfactants, are widely used in various personal hygiene products such as soaps, shampoos, and body washes. These ethoxylates effectively reduce the surface tension of water, allowing it to easily spread and dissolve dirt, oil, and other impurities from the skin and hair. One notable benefit of ethoxylates is their ability to boost foaming, which is often associated with effective cleansing. By enhancing the lather and foam formation in personal hygiene products like hand washes and toothpaste, ethoxylates contribute to the perception of cleanliness and aid in the even distribution of active ingredients. The significance of personal hygiene has been actively promoted by public health organizations, governments, and non-profit entities worldwide. Education campaigns focused on handwashing, oral care, and overall cleanliness have successfully raised consumer awareness and encouraged the adoption of better personal hygiene practices. Additionally, with the rise in disposable incomes in many developing economies, consumers are increasingly willing to invest in high-quality personal hygiene products. As a result, there is a growing demand for ethoxylates-based personal care items that offer enhanced cleansing and cosmetic benefits. Overall, the utilization of ethoxylates in personal hygiene products not only ensures effective cleansing but also contributes to improved consumer satisfaction and hygiene practices.

Growing Demand of Ethoxylates in Agrochemicals Industry

The global agrochemicals industry plays a pivotal role in ensuring food security and meeting the ever-growing demand for agricultural products. Ethoxylates, a class of organic compounds derived from ethylene oxide, are widely utilized in the formulation of various agrochemicals. These compounds possess surfactant properties that significantly enhance the performance and effectiveness of agricultural products. Ethoxylates serve a crucial purpose in stabilizing agrochemical formulations, preventing phase separation, and maintaining the physical and chemical properties of these products over time. This ensures that the agrochemicals remain potent and effective throughout storage and application, providing consistent and reliable results for farmers. In tank-mix applications, where multiple agrochemicals are combined, ethoxylates act as compatibility agents, effectively preventing any incompatibilities between different formulations. By doing so, they help maintain the stability and efficacy of tank mixtures, ensuring uniformity and minimizing any potential adverse effects. With the global population rapidly expanding, there is an increasing need to produce more food sustainably and efficiently. Ethoxylates play a crucial role in enhancing the performance of agrochemicals, enabling farmers to effectively protect their crops from pests, diseases, and weeds. The rising demand for food further drives the necessity for advanced agricultural solutions, leading to an increased usage of ethoxylates in agrochemical formulations. Notably, sustainable agriculture practices, such as integrated pest management and organic farming, have gained significant momentum in recent years. In this context, ethoxylates provide valuable tools for formulating environmentally friendly agrochemicals that minimize negative impacts on ecosystems and promote sustainable agricultural practices. By incorporating ethoxylates into agrochemical formulations, the industry can continue to address the growing global agricultural challenges while prioritizing sustainability and environmental stewardship.

Key Market Challenges

Volatility in Pricing and Availability of Global Ethoxylates Market

The cost of raw materials used in the production of ethoxylates, such as fatty alcohols and ethylene oxide, plays a significant role in determining their prices. Fluctuations in the prices of these raw materials directly impact the overall cost of ethoxylates, leading to price instability in the market. In addition to raw material costs, there are various other factors that can influence the pricing of ethoxylates. Regulatory requirements and policies related to the production, usage, and disposal of ethoxylates can have a significant impact. Compliance with environmental regulations and the adoption of sustainable practices may involve additional costs, which can affect the pricing of ethoxylates. Moreover, the availability of raw materials, such as fatty alcohols and ethylene oxide, can have a direct influence on the production capacity of ethoxylates. Any disruptions in the supply of these raw materials, such as natural disasters or geopolitical issues, can lead to limited availability of ethoxylates in the market. Furthermore, the capacity of ethoxylates production plants and the overall infrastructure for manufacturing these compounds can also impact their availability. Limited production capacity or outdated infrastructure may result in supply constraints, especially during periods of high demand. Considering all these factors, the pricing and availability of ethoxylates can be influenced by a complex interplay of market dynamics, regulatory requirements, raw material availability, and manufacturing infrastructure. Understanding these factors is crucial for stakeholders in the ethoxylates industry to navigate the market effectively and make informed decisions.

Growing Competition from Bio-based Surfactants

Bio-based surfactants, derived from renewable resources like plant oils, sugars, and biomass feedstocks, offer a sustainable and environmentally responsible alternative to traditional surfactants. As the world increasingly prioritizes sustainability, the demand for bio-based surfactants has been on the rise. Consumers, driven by their growing environmental consciousness, now seek out products that are both eco-friendly and sustainable. This shift in consumer behavior has led to the widespread adoption of bio-based surfactants in various consumer goods, including personal care products, household cleaning agents, and detergents. The increasing popularity of bio-based surfactants has also impacted the market for ethoxylates, which were previously the primary choice for many industries. With the transition to more sustainable alternatives, ethoxylates are losing market share. To stay competitive in the face of this growing competition, the ethoxylates industry must invest more in research and development. This includes exploring innovative manufacturing processes, enhancing the performance of ethoxylates, and finding ways to improve their sustainability profile. By embracing these changes and making strategic investments, the ethoxylates industry can adapt to the evolving market landscape and secure its position in the sustainable surfactants industry.

Key Market Trends

Growth in Technological Advancements

Technological advancements are revolutionizing the production processes of ethoxylates, leading to increased efficiency, productivity, and sustainability. The integration of artificial intelligence (AI) and machine learning algorithms in production systems enables real-time monitoring, predictive maintenance, and process optimization, resulting in improved operational performance and reduced downtime. These cutting-edge technologies empower manufacturers to identify and address inefficiencies, enhance product quality, and minimize overall production costs. Furthermore, advancements in chemical engineering and catalysis are facilitating the development of more sustainable and environmentally friendly manufacturing processes for ethoxylates. Through innovative approaches, such as green chemistry, researchers are exploring bio-based alternatives and minimizing the use of hazardous chemicals. These environmentally friendly ethoxylate formulations not only contribute to a greener future but also offer enhanced biodegradability and reduced waste generation. In addition to process improvements, advancements in nanotechnology have unlocked new possibilities for ethoxylates. The development of nanoscale ethoxylate particles has resulted in enhanced properties, including increased surface area and improved dispersion. These nano-ethoxylates find applications in diverse industries such as coatings, pharmaceuticals, and electronics, where precise control over particle size and distribution is crucial. As global regulatory frameworks become stricter regarding the use of harmful chemicals, technological advancements provide opportunities for ethoxylate producers to align with sustainability goals. By leveraging these advancements and embracing innovative solutions, the ethoxylate industry can continue to evolve and contribute to a more sustainable and environmentally conscious future.

Segmental Insights

Type Insights

In 2022, the Ethoxylates market was dominated by the Alcohol Ethoxylate and is predicted to continue expanding over the coming years. Alcohol ethoxylates (AE) are widely recognized as essential commodities in surfactant manufacturing. They hold a significant position as the largest downstream sector of fatty alcohols. With their remarkable properties such as rapid biodegradation, superior cleaning performance on man-made fibres, and excellent tolerance toward water hardness, they have become highly favoured for use in laundry detergent formulations. The production of alcohol ethoxylates encompasses both synthetic and natural sources. The synthetic form dominates the markets in Europe and the U.S., while the Asia Pacific region predominantly prefers the natural form, including fatty alcohol ethoxylates (FAE), due to the abundant availability of raw materials. Beyond their role in surfactant production, alcohol ethoxylates also play a vital part in the textile industry. They are pivotal in various processes such as scouring, lubricating, and dyeing, where they contribute to reducing curds and minimizing scouring time. The consumption of alcohol ethoxylates in these textile applications has witnessed a notable increase attributed to the growing population and rising disposable income. Moreover, the paint industry is anticipated to drive the demand for alcohol ethoxylates further. Emulsification, a crucial process in the paint industry, is expected to experience a surge due to rapid infrastructural development across the globe. Overall, alcohol ethoxylates have proven to be versatile compounds with diverse applications, making them an indispensable component in several industries.

End User Insights

In 2022, the Ethoxylates market was dominated by Household & Personal Care and is predicted to continue expanding over the coming years. The growth in this segment can be largely attributed to its widespread use in the formulation of a wide range of household cleaning products. These products include not only laundry detergents in both liquid and powder forms, but also dishwashing gels and detergents, fabric conditioners, glass cleaners, carpet cleaners, oven cleaners, air fresheners, and hard floor and surface cleaners. The versatility of this ingredient makes it an indispensable component in the cleaning routines of millions of households around the world, ensuring effective and efficient cleaning results.

Related Reports

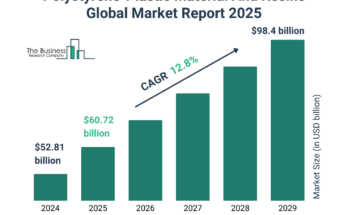

Polyetheramine Market [2028]: Analysis & Forecast

Sorbitol Market – Opportunities, Size & Growth [2028]

Table of Content-Ethoxylates Market

- Product Overview

1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

- Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

3.1. Overview of the Market

3.2. Overview of Key Market Segmentations

3.3. Overview of Key Market Players

3.4. Overview of Key Regions/Countries

3.5. Overview of Market Drivers, Challenges, Trends

- Global Ethoxylates Market Outlook

4.1. Market Size & Forecast

4.1.1. By Value & Volume

4.2. Market Share & Forecast

4.2.1. By Type (Alcohol Ethoxylates, Fatty Amine Ethoxylates, Fatty Acid Ethoxylates, Methyl Ester Ethoxylates, Glyceride Ethoxylates, Others)

4.2.2. By End User (Household & Personal Care, Pharmaceutical, Agrochemicals, Oilfield Chemicals, Others)

4.2.3. By Region

4.2.4. By Company (2022)

4.3. Market Map

- North America Ethoxylates Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value & Volume

5.2. Market Share & Forecast

5.2.1. By Type

5.2.2. By End User

5.2.3. By Country

5.3. North America: Country Analysis

5.3.1. United States Ethoxylates Market Outlook

5.3.1.1. Market Size & Forecast

5.3.1.1.1. By Value & Volume

5.3.1.2. Market Share & Forecast

5.3.1.2.1. By Type

5.3.1.2.2. By End User

5.3.2. Mexico Ethoxylates Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value & Volume

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Type

6.3.2.2.2. By End User

6.3.3. Canada Ethoxylates Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value & Volume

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Type

6.3.3.2.2. By End User

- Europe Ethoxylates Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value & Volume

6.2. Market Share & Forecast

6.2.1. By Type

6.2.2. By End User

6.2.3. By Country

7.3 Europe: Country Analysis

7.3.1. France Ethoxylates Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value & Volume

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Type

7.3.1.2.2. By End User

7.3.2. Germany Ethoxylates Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value & Volume

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Type

7.3.2.2.2. By End User

7.3.3. United Kingdom Ethoxylates Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value & Volume

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Type

7.3.3.2.2. By End User

7.3.4. Italy Ethoxylates Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value & Volume

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Type

7.3.4.2.2. By End User

7.3.5. Spain Ethoxylates Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value & Volume

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Type

7.3.5.2.2. By End User

- Asia-Pacific Ethoxylates Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value & Volume

7.2. Market Share & Forecast

7.2.1. By Type

7.2.2. By End User

7.2.3. By Country

7.3. Asia-Pacific: Country Analysis

7.3.1. China Ethoxylates Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value & Volume

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Type

7.3.1.2.2. By End User

7.3.2. India Ethoxylates Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value & Volume

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Type

7.3.2.2.2. By End User

7.3.3. South Korea Ethoxylates Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value & Volume

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Type

7.3.3.2.2. By End User

7.3.4. Japan Ethoxylates Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value & Volume

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Type

7.3.4.2.2. By End User

7.3.5. Australia Ethoxylates Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value & Volume

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Type

7.3.5.2.2. By End User