Europe Life Reinsurance Market Overview:

The study covers the global Europe Life Reinsurance market in depth, precisely, and completely, with a focus on market dynamics, market competition, regional growth, segmental analysis, and significant growth plans. Data on market growth, as well as market segmentation by regions, product type, application, and industry end-use, are included in the report. Experts provide detailed and exact marketing research reports using the most up-to-date Europe Life Reinsurance Market research techniques and technology. The Europe Life Reinsurance market size and share, as well as a wide range of industry verticals, are all thoroughly examined in this study.

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/189858

Europe Life Reinsurance Market Dynamics:

The expanding need for life insurance raises the need for reinsurance protection to keep up with the growth of the insurance industry. The need for life insurance coverage is expanding due to factors such rising incomes, the need for retirement planning, and growing knowledge of financial security. By offering reinsurance capacity, reinsurers facilitate the expansion of life insurers. The goal of life insurance is to reduce the risks that they are exposed to, including the risks of death, sickness, and longevity. By shielding them from losses in these areas, life reinsurance companies assist life insurance companies in their efforts to enter new markets. As a result, the market for life reinsurance in Europe is seeing growth in demand.

Europe Life Reinsurance Market Segmentation:

by Type

1.Facultative Reinsurance

2.Treaty Reinsurance

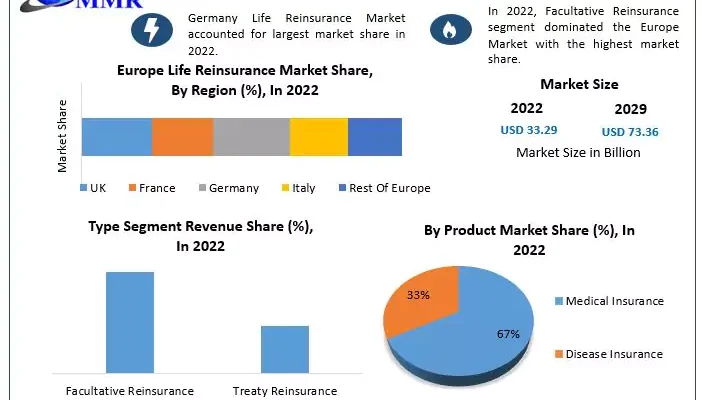

Life reinsurance is divided into two categories: treaty reinsurance and facultative reinsurance.

Life Reinsurance Company analyses and determines whether to accept or reject specific risks with the assistance of the facultative section. Because facultative reinsurance policies can be tailored to individual situations, they are usually employed for high-value or hazardous risks. An analysis carried out by an insurer to cover just risks, or a block of risks taken into consideration in the insurer’s book of business, is known as facultative reinsurance. Thus, throughout the duration of the projection period, the facultative reinsurance segment is anticipated to maintain its dominant position in the Europe Life Reinsurance Market.

by Product

1.Disease Insurance

2.Medical Insurance

The Europe Life Reinsurance Market is divided into two segments based on product: Medical Insurance and Illness Insurance.

With a substantial market share of 67.19%, the medical insurance sector leads the Europe Life Reinsurance Market. This is so that a variety of medical costs, such as doctor visits, hospital stays, and prescription medication, can be covered by medical insurance. The ageing population, the rise in chronic illness prevalence, and the rising expense of healthcare are some of the factors driving the expansion of the medical insurance market. Premiums for medical insurance are usually less expensive than those for illness insurance. This is so that a greater variety of medical expenses can be covered by medical insurance, which is a more extensive product. For this reason, the market category for life reinsurance is dominated by medical insurance.

by Distribution Channel

1.Direct Writing

2.Agent and Broker

3.Bank

by Category

1.Recurring reinsurance

2.Portfolio reinsurance

3.Retrocession reinsurance

by End-Users

1.Children

2.Adults

3.Senior Citizens

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/189858

Europe Life Reinsurance Market Scope:

This study delves deeply into demand estimations, market trends, and micro and macro aspects. The aspects that are fueling and limiting the market’s growth are also highlighted in this report. The MMR Matrix in the study provides existing and new market participants with information on potential investment opportunities. The research employs analytical methodologies such as Porter’s five forces analysis and PESTLE of the Europe Life Reinsurance market to generate market insights. Current market trends and forecasts for the years 2023-2029 are also examined in the study. The research also identified significant upcoming developments that will affect demand over the predicted period.

Europe Life Reinsurance Market Key Players:

1.AXIS

2. GIC Re

3. Great-West Lifeco

4.Hannover Re

5. Lloydâs

6.Mapfre

7. Munich Re

8.Swiss Re

9.XL Catlin

For any Queries Linked with the Report, Ask an Analyst@ https://www.maximizemarketresearch.com/market-report/europe-life-reinsurance-market/189858/

Regional Analysis:

Thanks to the geographical insights in the reports, readers will be well-informed on the Europe Life Reinsurance market on a regional level. A detailed awareness of local energy, economic, political, and geographic factors is required for any meaningful assessment of potential policy options in response to global market change. The study provides readers with regional perspectives on Europe Life Reinsurance market and local growth potential, as well as domestic area restraints.

- Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

- Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

- North America (the United States, Mexico, and Canada.)

- South America (Braazil etc.)

- The Middle East and Africa (GCC Countries and Egypt.)

COVID-19 Impact Analysis on Europe Life Reinsurance Market:

The impact of COVID-19 on the market is thoroughly examined in the Europe Life Reinsurance market research. As a result of the COVID-19 problem, researchers at Maximize Market Research, who are following the situation across the globe, believe that the market will provide profitable opportunities for producers. The report’s purpose is to provide a more comprehensive view of the current situation, the economic downturn, and the influence of COVID-19 on the entire industry.

The research provides data-driven insights and recommendations on a variety of topics. The following are some of the most significant inquiries:

- What are the major current developments that could affect the product’s life cycle and return on investment?

- What are the implications of regulatory changes on corporate, business, and functional strategies?

- Will the micromarketing efforts of the main players result in investment?

- What are the best frameworks and methodologies for PESTLE analysis?

- In what areas will there be more new opportunities?

- What are the game-changing technologies that will be used to capture new revenue streams in the near future?

- How can various players develop client loyalty utilising distinct operational and tactical frameworks?

- What is the current and expected degree of market competition in the near future?

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Our Address

- MAXIMIZE MARKET RESEARCH PVT. LTD.

- ⮝ 3rd Floor, Navale IT park Phase 2,

- Pune Banglore Highway, Narhe

- Pune, Maharashtra 411041, India.

- ✆ +91 9607365656

- 🖂 sales@maximizemarketresearch.com

- www.maximizemarketresearch.com