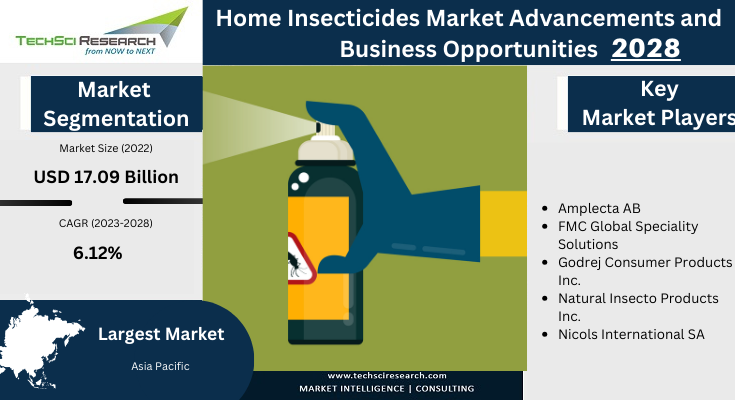

According to TechSci Research report, “Home Insecticides Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the Global Home Insecticides Market stood at USD 17.09 Billion in 2022 and is anticipated to grow with a CAGR of 6.12% in the forecast period, 2024-2028. Global Home Insecticides Market is experiencing significant growth, driven by a multitude of factors that reflect the increasing need for pest control and hygiene in households across the globe. As urbanization, population growth, and changing lifestyles continue to shape our living spaces, the demand for home insecticides has never been higher. One of the primary drivers of the home insecticides market is the relentless pace of urbanization. As more people move from rural areas to cities, they often encounter new pest challenges in their living spaces. Crowded urban environments create ideal conditions for the proliferation of common household pests, such as mosquitoes, flies, cockroaches, and ants. These pests pose health risks and nuisances, spurring urban dwellers to seek effective solutions, thus driving the demand for home insecticides.

Growing awareness of health and sanitation is another crucial driver. Consumers are becoming increasingly conscious of the health risks associated with pests and the diseases they can transmit. In regions where vector-borne diseases are prevalent, such as malaria and dengue, home insecticides are seen as a critical line of defense. Additionally, the COVID-19 pandemic heightened awareness of hygiene and cleanliness, leading to a surge in demand for home insecticides as people spent more time indoors. The global shift towards eco-friendliness and sustainability is reshaping the home insecticides market. Traditional chemical insecticides are being replaced by safer, eco-friendly alternatives. Consumers are concerned about the environmental impact and potential health hazards associated with chemical insecticides, leading to a preference for natural and organic insect repellents. Manufacturers are responding to this demand by developing products that are not only effective against pests but also environmentally friendly.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on “Global Home Insecticides Market.” @ https://www.techsciresearch.com/report/home-insecticides-market/19554.html

In recent years, there has been a noticeable shift towards sustainable and eco-friendly agricultural practices. Consumers and regulatory bodies alike are increasingly concerned about the environmental impact of agricultural chemicals. This has led to the development of safer and more environmentally friendly formulations of isoxaflutole. Manufacturers are investing in research to reduce the chemical’s environmental footprint and improve its overall sustainability. As sustainability gains importance, eco-friendly formulations of Home Insecticides are expected to gain traction in the market.

The Home Insecticides market is highly regulated due to environmental and safety concerns. Obtaining regulatory approvals for herbicides can be a lengthy and complex process. However, the demand for Home Insecticides is driven by its effectiveness in weed control and its compatibility with GM crops. Companies in the agrochemical industry continue to invest in research and development to ensure that their products meet stringent regulatory standards. Compliance with evolving regulatory requirements is a key driver in shaping the future of the Home Insecticides market.

The Global Home Insecticides Market is segmented into Insect Type, Form, Chemical Type, Regional Distribution, and Company.

Based on the Insect Type, Mosquitoes & Flies emerged as the dominant segment in the global market for Global Home Insecticides Market in 2022. Mosquitoes and flies are ubiquitous pests that are not only a nuisance but also vectors for various diseases, making them a primary target for pest control in households worldwide. Mosquitoes, in particular, are known carriers of diseases such as malaria, dengue fever, Zika virus, and West Nile virus. Their presence poses significant health risks, especially in regions where these diseases are endemic. As a result, households in these areas prioritize mosquito control to protect their families from mosquito-borne illnesses.

Based on the Form, Aerosol Sprays emerged as the dominant segment in the global market for Global Home Insecticides Market in 2022. Aerosol sprays are incredibly easy to use. They come in user-friendly cans with precise spray mechanisms, allowing consumers to target pests accurately. This simplicity makes aerosol sprays accessible to a wide range of users, from young adults to the elderly. Aerosol sprays provide on-the-spot pest control. When homeowners encounter a pest problem, they can quickly grab an aerosol can and apply the product directly to the affected area, instantly addressing the issue. This convenience aligns with consumers’ desire for quick and efficient solutions to pest problems. Aerosol sprays offer precise application, minimizing waste and overspray. Users can aim the spray precisely at pests or areas where pests are likely to hide, reducing the likelihood of product misuse and minimizing exposure to humans, pets, and non-target species.

Based on the Chemical Type, Synthetic insecticides emerged as the dominant segment in the global market for Global Home Insecticides Market in 2022. The choice between synthetic and natural insecticides depends on factors such as the severity of the pest problem, environmental concerns, and personal preferences. In situations where a quick and robust response is needed, synthetic insecticides are typically favored. Synthetic insecticides are typically formulated with chemical compounds that are engineered to target specific pests efficiently. They often provide rapid and potent results, making them a preferred choice for consumers looking for immediate relief from pest infestations. Synthetic insecticides are also known for their residual effectiveness, meaning they can continue to protect treated areas for an extended period, which is especially important in-home pest control.

Asia-Pacific emerged as the dominant player in the global Home Insecticides Market in 2022, holding the largest market share. Increasing health and sanitation awareness among consumers in Asia-Pacific have led to a greater emphasis on maintaining clean and pest-free living environments. The COVID-19 pandemic further underscored the significance of hygiene and cleanliness, resulting in a surge in demand for home insecticides as people spent more time indoors. Asia-Pacific is known for its diverse climates and ecosystems, leading to a wide variety of pests that pose unique challenges. These pests include not only mosquitoes and flies but also bedbugs, termites, and other insects, each requiring specific pest control measures. This diversity of pests contributes to the robust demand for a wide range of home insecticide products.

Asia-Pacific is home to some of the world’s most densely populated urban areas. Rapid urbanization and population growth have created highly conducive environments for pest infestations. As more people move into urban centers, the demand for effective home insecticides has surged to combat common household pests like mosquitoes, flies, ants, and cockroaches. Many countries in the Asia-Pacific region are endemic to vector-borne diseases such as malaria, dengue fever, and Zika virus. The prevalence of these diseases has heightened awareness of the importance of pest control, particularly mosquito control, further driving the demand for home insecticides.

Major companies operating in the Global Home Insecticides Market are:

- Amplecta AB

- FMC Global Speciality Solutions

- Godrej Consumer Products Inc.

- Natural Insecto Products Inc.

- Nicols International SA

- Shogun Organics

- Spectrum Brands holdings

To Download FREE Sample Pages of this Report

@ https://www.techsciresearch.com/sample-report.aspx?cid=19554

Customers can also request for 10% free customization on this report.

“The Global Home Insecticides Market is poised for continued growth in the coming years. Several factors are expected to drive this expansion, including increasing urbanization, rising health and sanitation awareness, and the relentless pursuit of innovative pest control solutions. Urbanization continues to create densely populated areas where pests thrive, making effective home insecticides a necessity for millions of households worldwide. The ongoing awareness of health risks posed by pests and the importance of maintaining clean living spaces are driving consumer demand for pest control products. Additionally, the market is witnessing continuous innovation, with the integration of smart technology and the development of eco-friendly formulations, catering to evolving consumer preferences.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Home Insecticides Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028 Segmented By Insect Type (Mosquitoes & Flies, Rats & other Rodents, Termites, Bedbugs & Beetles, Other Insect Types), By Chemical Type (Synthetic, Natural), By Form (Dust and Granules, Liquids, Aerosol Sprays, Other Forms) Region and Competition”, has evaluated the future growth potential of Global Home Insecticides Market and provides statistics & information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision-makers make sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Home Insecticides Market.

You may also read:

Space Carbon Fiber Composite Market Worth [2028], Overview, Trends, Forecast

Long-Range Ordered Porous Carbon (LOPC) Market Value, Trends [2028], Economy, Expansion, Leader

Petroleum Coke Market – A Comprehensive Report [2028]

Polyurethane (PU) Coatings Market [2028] Exploring Potential, Growth, Future & Trends

Table of Content-Home Insecticides Market

- Product Overview

1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

- Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

3.1. Overview of the Market

3.2. Overview of Key Market Segmentations

3.3. Overview of Key Market Players

3.4. Overview of Key Regions/Countries

3.5. Overview of Market Drivers, Challenges, Trends

- Global Home Insecticides Market Outlook

4.1. Market Size & Forecast

4.1.1. By Value

4.2. Market Share & Forecast

4.2.1. By Insect Type (Mosquitoes & Flies, Rats & other Rodents, Termites, Bedbugs & Beetles, Other Insect Types)

4.2.2. By Chemical Type (Synthetic, Natural)

4.2.3. By Form (Dust and Granules, Liquids, Aerosol Sprays, Other Forms)

4.2.4. By Region

4.2.5. By Company (2022)

4.3. Market Map

4.3.1. By Insect Type

4.3.2. By Chemical Type

4.3.3. By Form

4.3.4. By Region

- Asia Pacific Home Insecticides Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Insect Type

5.2.2. By Chemical Type

5.2.3. By Form

5.2.4. By Country

5.3. Asia Pacific: Country Analysis

5.3.1. China Home Insecticides Market Outlook

5.3.1.1. Market Size & Forecast

5.3.1.1.1. By Value

5.3.1.2. Market Share & Forecast

5.3.1.2.1. By Insect Type

5.3.1.2.2. By Chemical Type

5.3.1.2.3. By Form

5.3.2. India Home Insecticides Market Outlook

5.3.2.1. Market Size & Forecast

5.3.2.1.1. By Value

5.3.2.2. Market Share & Forecast

5.3.2.2.1. By Insect Type

5.3.2.2.2. By Chemical Type

5.3.2.2.3. By Form

5.3.3. Australia Home Insecticides Market Outlook

5.3.3.1. Market Size & Forecast

5.3.3.1.1. By Value

5.3.3.2. Market Share & Forecast

5.3.3.2.1. By Insect Type

5.3.3.2.2. By Chemical Type

5.3.3.2.3. By Form

5.3.4. Japan Home Insecticides Market Outlook

5.3.4.1. Market Size & Forecast

5.3.4.1.1. By Value

5.3.4.2. Market Share & Forecast

5.3.4.2.1. By Insect Type

5.3.4.2.2. By Chemical Type

5.3.4.2.3. By Form

5.3.5. South Korea Home Insecticides Market Outlook

5.3.5.1. Market Size & Forecast

5.3.5.1.1. By Value

5.3.5.2. Market Share & Forecast

5.3.5.2.1. By Insect Type

5.3.5.2.2. By Chemical Type

5.3.5.2.3. By Form

- Europe Home Insecticides Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Insect Type

6.2.2. By Chemical Type

6.2.3. By Form

6.2.4. By Country

6.3. Europe: Country Analysis

6.3.1. France Home Insecticides Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Insect Type

6.3.1.2.2. By Chemical Type

6.3.1.2.3. By Form

6.3.2. Germany Home Insecticides Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Insect Type

6.3.2.2.2. By Chemical Type

6.3.2.2.3. By Form

6.3.3. Spain Home Insecticides Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Insect Type

6.3.3.2.2. By Chemical Type

6.3.3.2.3. By Form