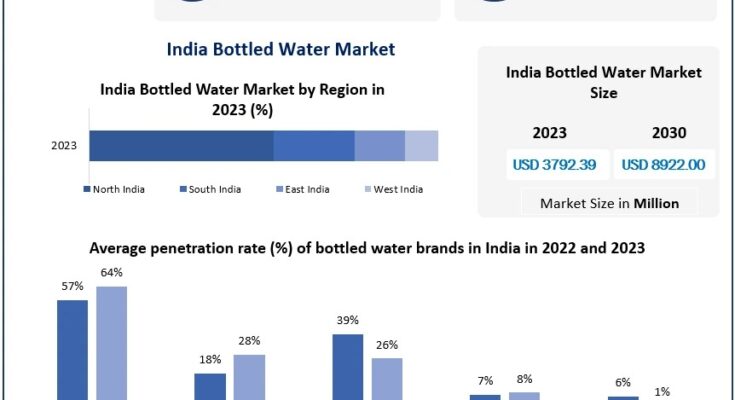

The India bottled water market is experiencing tremendous growth, driven by increasing consumer awareness of health and wellness, along with a rising demand for clean and purified drinking water. In 2024, the market is projected to grow even further, with mergers, acquisitions, and product innovations playing a central role in shaping its future. As consumers in India continue to demand high-quality, convenient hydration options, companies are adapting with innovative strategies to expand their market share.

For a detailed overview, click on the link provided: https://www.maximizemarketresearch.com/request-sample/20197/

Key Trends in India’s Bottled Water Market

The bottled water market in India is not only expanding due to changing consumer preferences but also benefiting from advancements in packaging technologies, sustainability initiatives, and e-commerce platforms. Below are the key trends expected to drive the market forward in 2024:

1. Growing Demand for Premium and Functional Waters

Consumers are increasingly seeking premium bottled water that offers not just hydration but also additional health benefits. Waters enriched with minerals, vitamins, and electrolytes are gaining popularity. Furthermore, alkaline and sparkling waters are emerging as trendy alternatives to regular bottled water.

2. Focus on Health and Wellness

In line with global health and wellness trends, Indian consumers are becoming more conscious about the quality and source of their drinking water. The shift toward purified, mineral-rich, and natural spring water is expected to continue, especially among the middle and upper-income populations.

3. Rise of Sustainable Packaging Solutions

Sustainability is at the forefront of the bottled water industry. To meet consumer demands for eco-friendly products, many companies are shifting towards biodegradable, recyclable, and lightweight packaging. The use of PET bottles and alternatives, such as paper-based packaging, is growing as companies attempt to reduce their carbon footprint.

4. E-Commerce Adoption

With the increasing reliance on online shopping, bottled water brands are leveraging e-commerce platforms for wider distribution. This trend is especially popular in urban areas where consumers are looking for convenience and home delivery options for their drinking water needs.

Mergers and Acquisitions in the Bottled Water Market: Key Global Developments

The global bottled water industry is seeing a series of mergers and acquisitions (M&As) that reflect the growing interest in market consolidation, sustainability, and diversification. Key companies from countries like Vietnam, Thailand, Singapore, Japan, South Korea, the United States, and Europe are actively pursuing strategic deals to expand their reach.

Key Mergers and Acquisitions:

- Vietnam: Sao Mai Group, a leading producer of bottled water in Vietnam, recently acquired Vietnam Springs, a local bottled water brand known for its mineral-rich waters. The acquisition will strengthen Sao Mai’s position in the Southeast Asian market and help the company tap into the growing demand for premium bottled water.

- Thailand: Thai Beverage (makers of Oishi Water) acquired Pocari Sweat Thailand, a subsidiary of the Japanese company Otsuka Pharmaceutical. This acquisition enables Thai Beverage to diversify its water offerings by adding functional and vitamin-enhanced waters to its product range.

- Singapore: Hyflux, a water treatment and bottled water company in Singapore, was acquired by Suez in 2023. The acquisition provides Suez with access to Hyflux’s cutting-edge water purification technology, enabling both companies to offer premium bottled water and environmental solutions across Southeast Asia.

- Japan: Asahi Group acquired The Suntory Group’s bottled water division in early 2023. This strategic acquisition allows Asahi to strengthen its bottled water segment, particularly in the Asian and European markets, where demand for premium water products is rising.

- South Korea: In late 2023, Lotte Chilsung Beverage (South Korea) acquired a controlling stake in Vitasoy, a beverage company known for its bottled water and health drinks. The acquisition expands Lotte’s footprint in the growing health-conscious bottled water segment.

- United States: Nestlé Waters North America was acquired by One Rock Capital Partners in 2023. This acquisition has allowed One Rock to expand its footprint in the bottled water industry, including brands like Poland Spring and Pure Life, as well as its entry into the expanding premium water market.

- Europe: Danone acquired Evian‘s competitor Volvic in a strategic move to consolidate its bottled water operations in Europe. With Volvic’s established brand equity, Danone aims to expand its footprint in both premium and functional bottled water segments.

For a detailed overview, click on the link provided: https://www.maximizemarketresearch.com/request-sample/20197/

India Bottled Water Market Scope:

by Product

Flavoured Water

Purified Water

Mineral Water

Sparkling Water

The Indian market for bottled water is divided into several product categories, including mineral, sparkling, flavoring, and filtered water. With a market share of over 40.0% in 2023, the purified category is expected to continue to dominate the market throughout the duration of the forecast. Because polluted particles in running water are often the source of diseases like typhoid, dysentery, and diarrhea, consumers are looking for ways to save water, and companies are facing similar difficulties. For instance, Aquafina offers filtered, sodium-free pure drinking options.

by Packaging Type

PET (Polyethylene Terephthalate) Bottles

Water Cans

Others

by Distribution Channel

Supermarkets and Hypermarkets

Specialty Stores

Online

Others

The India Bottled Water Market is divided into off-trade and on-trade segments based on the distribution route. In 2023, the off-trade category had the most revenue share, accounting for 85.6%. All retail establishments, including supermarkets, hypermarkets, convenience shops, micro markets, and traditional stores, are included in this sector. The growing convenience of quickly choosing the preferred brand of bottled water with a certain mineral combination is propelling the growth of the India Bottled Water Market over the projected period. The off-trade market carries brands including Himalayan, Bailley, Kinley, Bisleri, and Aquafina.

For a detailed overview, click on the link provided: https://www.maximizemarketresearch.com/request-sample/20197/

Leading Companies in the Indian Bottled Water Market

The Indian bottled water market is home to several large and established brands. Key players in this space are focusing on product innovation, sustainability initiatives, and digital transformation to maintain their competitive edge. Some of the most prominent brands include:

- Nestlé India: As one of the leading bottled water brands in India, Nestlé Pure Life continues to dominate the market, with its focus on providing safe and pure drinking water to consumers. Nestlé’s push for eco-friendly packaging and expanding its distribution network has helped it maintain a leadership position in the market.

- Coca-Cola India: Kinley, Coca-Cola’s bottled water brand, has seen consistent growth in India. The company’s ongoing efforts in product innovation, especially with its focus on mineral-enriched waters, have contributed to the brand’s continued success in a competitive market.

- Bisleri International: Bisleri is one of India’s most recognizable bottled water brands, known for its packaging and purification processes. The company is investing heavily in expanding its presence in rural areas, which is expected to drive future growth.

- Parle Agro: Known for Bovonto and Appy Fizz, Parle Agro has also established itself as a major player in the bottled water market through its brand Bael Water. Parle is focusing on affordable bottled water options for urban and rural customers alike.

- Indian Beverage Pvt. Ltd.: Known for its premium brand AQUA RICH, the company is making significant inroads into the bottled water market by emphasizing purity and minerals. AQUA RICH is targeting urban professionals and health-conscious consumers.

- Aqua Mineral: A growing regional player in the bottled water sector, Aqua Mineral is focusing on expanding its distribution network and increasing brand awareness in tier-2 and tier-3 cities in India.