Anticipated Growth in Revenue:

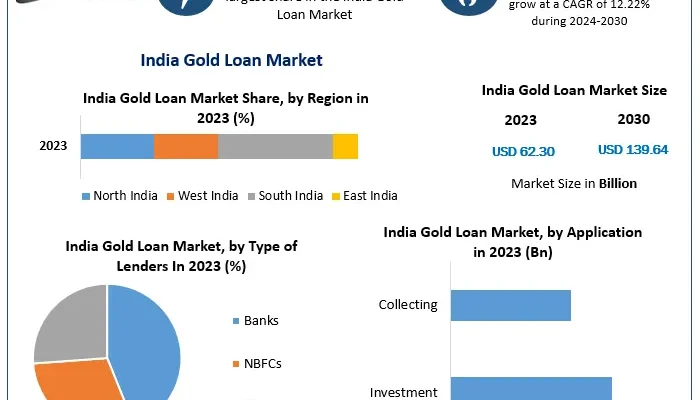

India Gold Loan Market size was valued at USD 62.30 Billion in 2023 and the total India Gold Loan Market is expected to grow at a CAGR of 12.22% from 2024 to 2030, reaching nearly USD 139.64 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has witnessed significant growth due to the increasing reliance on gold assets as a means of securing quick and hassle-free credit. As a deeply ingrained cultural asset, gold is widely owned across Indian households, making gold loans an accessible financial product for a broad spectrum of the population. Financial institutions and non-banking financial companies (NBFCs) have leveraged this trend by offering competitive interest rates, simplified documentation, and rapid loan disbursement processes. This has made gold loans a preferred choice for addressing short-term financial needs, especially in rural and semi-urban areas.

Get Free Access to Our Sample Report:https://www.maximizemarketresearch.com/request-sample/213911/

India Gold Loan Market Trends:

One of the key drivers of the India Gold Loan Market is the growing demand for financial inclusion and access to credit in rural and semi-urban areas. In these regions, where conventional banking services may be limited, gold loans provide an effective solution for meeting personal and business-related financial needs. The minimal eligibility criteria and flexibility in repayment terms make gold loans particularly attractive for small business owners, farmers, and self-employed individuals.

What are India Gold Loan Market Dynamics?

The dynamics of the India Gold Loan Market are shaped by a combination of economic, cultural, and technological factors. Demand for accessible credit is a significant driver, with gold loans offering a quick, collateral-based solution that caters to both urban and rural borrowers. The cultural significance of gold in Indian households further supports this market, as it serves as a readily available asset for financial emergencies or business investments. Additionally, the rising volatility in gold prices enhances the market’s appeal, allowing borrowers to leverage higher loan amounts with the same collateral.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/213911/

India Gold Loan Market Opportunities:

The India Gold Loan Market offers substantial opportunities for financial institutions to expand their footprint, particularly in underserved rural and semi-urban regions. By establishing more localized branches and utilizing mobile banking units, companies can tap into these high-potential markets. Additionally, the increasing acceptance of gold loans as a business financing tool provides significant growth prospects, as more entrepreneurs and small enterprises seek to leverage their gold assets for working capital and expansion.

What is India Gold Loan Market Regional Insight?

The India Gold Loan Market exhibits distinct regional variations, with South India leading the market in terms of both demand and supply. This dominance can be attributed to the region’s cultural affinity for gold, coupled with a well-established network of financial institutions and NBFCs offering gold loan products. States like Tamil Nadu, Kerala, and Karnataka have a high penetration of gold loans, supported by a strong gold ownership tradition and awareness of gold loan benefits.

Get An Exclusive Sample Of The India Gold Loan Market Report At This Link (Get The Higher Preference For Corporate Email ID):https://www.maximizemarketresearch.com/request-sample/213911/

What is India Gold Loan Market Segmentation?

By Vehicle Type

Battery-Electric Cars

Plug-in Hybrid Electric Cars

Fuel Cell Electric Cars

By End User

Individual Consumers

Fleet Owners and Operators

Car Rental Companies

Others

Some of the current players in the India Gold Loan Market are:

1. Axis Bank of India

2. Central Bank of India

3. Federal Bank Limited

4. HDFC Bank Limited

5. ICICI Limited

6. Kotak Mahindra Bank Limited

7. Manappuram Finance Limited

8. Muthoot Finance Limited

9. State Bank of India

10. Union Bank of India

11. India Infoline Finance Limited

12. Canara Bank

13. Bank of Baroda

14. Punjab National Bank

15. Nitstone Finserv

16. Attica Gold Company

17. Rupeek Gold Loans

18. Reliant Gold Loan

19. Indian Overseas Bank

20. Tamilnad Mercantile Bank

21. Punjab and Sind Bank

22. Bajaj Finserv

23. NBFCs

24. UCO Bank

25. Karnataka Bank

Know More About The Report:https://www.maximizemarketresearch.com/market-report/india-gold-loan-market/213911/

Key Offerings:

- Past Market Size and Competitive Landscape

- India Gold Loan Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- India Gold Loan Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

For additional reports on related topics, visit our website:

Space Battery Market https://www.maximizemarketresearch.com/market-report/global-space-battery-market/31284/

Wheel Hub Assembly Market https://www.maximizemarketresearch.com/market-report/wheel-hub-assembly-market/105078/

Air Quality Control Systems Market https://www.maximizemarketresearch.com/market-report/global-air-quality-control-systems-market/34001/

Electric Motor Market https://www.maximizemarketresearch.com/market-report/global-electric-motor-market/20951/

Steam Turbine Market https://www.maximizemarketresearch.com/market-report/global-steam-turbine-market/29554/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 [email protected]

🌐 www.maximizemarketresearch.com