Introduction: The Growing Gem and Jewellery Market in India

India’s gem and jewellery market is undergoing significant transformation, driven by a growing middle-class population, rising disposable incomes, and a strong inclination toward luxury goods. As one of the largest global markets for gems and jewellery, India continues to dominate in both production and consumption, particularly in gold and diamond jewellery. The market is poised for substantial growth in 2024, with key mergers and acquisitions further reshaping the competitive landscape.

Click here for a more detailed explanation: https://www.maximizemarketresearch.com/request-sample/122565/

Key Developments in the Indian Gem and Jewellery Market

The India Gem and Jewellery Market has seen consistent growth, driven by both domestic consumption and export demand. Several key trends are shaping this market, including rising consumer preference for artisanal and designer jewellery, sustainable practices, and the increasing influence of e-commerce. Below are the key developments:

1. E-Commerce and Digitalization Transforming the Industry

The rise of online shopping is a key factor driving the growth of India’s gem and jewellery market. With more consumers opting for online purchases, jewellery brands are increasingly establishing a digital presence. In 2024, the shift to e-commerce is expected to continue, particularly with the rise of mobile-first solutions targeting younger consumers.

2. Sustainable and Ethical Sourcing Trends

Consumers, particularly millennials and Gen Z, are increasingly concerned with the ethical sourcing of gems and the environmental impact of jewellery production. The market is witnessing a growing demand for lab-grown diamonds and conflict-free gems, a trend that is reshaping supply chains and production processes in India.

3. Rising Affluence and Middle-Class Growth in India

India’s growing affluence and the rise of a wealthy middle class are contributing to the demand for both traditional and modern jewellery designs. The expansion of disposable income, especially in urban centers, is fueling demand for high-end, luxury jewellery pieces.

Mergers and Acquisitions in the Global Gem and Jewellery Market

The global gem and jewellery market is also witnessing an increasing number of mergers and acquisitions, allowing companies to expand their product portfolios, enter new markets, and leverage technological advancements. The key mergers and acquisitions taking place across countries such as Vietnam, Thailand, Singapore, Japan, South Korea, European nations, and the US are reshaping the market in 2024.

Key Mergers and Acquisitions:

- Vietnam: In 2023, VietGem, one of Vietnam’s leading jewellery brands, acquired GiaSon Jewellery, a prominent diamond exporter. This acquisition is expected to enhance VietGem’s portfolio and allow the company to expand its footprint in international markets, particularly in Southeast Asia and Europe.

- Thailand: Thai Gold Corporation, a leading jewellery manufacturer, recently acquired Royal Gem Thailand, a premium jewellery brand known for its intricate designs and high-quality gemstones. This acquisition will help Thai Gold strengthen its luxury jewellery segment, with an eye on expanding into international markets, including the Middle East.

- Singapore: Tanishq, a global jewellery giant, recently completed the acquisition of Gem Dynasty, a Singapore-based luxury gem retailer. This move is set to strengthen Tanishq’s position in the Southeast Asian market, particularly in luxury gems and diamonds.

- Japan: Mikimoto, a well-established jewellery brand specializing in pearls, recently acquired Tokyo Gemstones, a prominent diamond retailer. The acquisition strengthens Mikimoto’s position in the premium jewellery market, particularly in the Asian and European regions.

- South Korea: LG Household & Health Care recently acquired Suwon Gemstones, one of South Korea’s leading jewellery companies. This acquisition enables LG to diversify its offerings into luxury jewellery, leveraging its established presence in the beauty and personal care sectors.

- United States: Blue Nile, a leading online jewellery retailer, acquired James Allen, another prominent online jewellery retailer in the US, in 2023. The acquisition expands Blue Nile’s market share and strengthens its position in the growing e-commerce jewellery sector.

- Europe: Chopard, a Swiss luxury brand known for its jewellery and watches, acquired Bvlgari’s gemstone division in 2023. The acquisition allows Chopard to expand its product line and compete more effectively in the high-end luxury jewellery market.

Click here for a more detailed explanation: https://www.maximizemarketresearch.com/request-sample/122565/

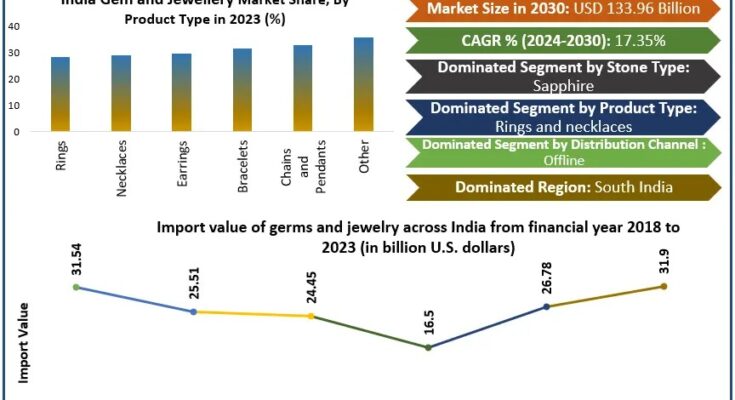

India Gem and Jewellery Market Scope:

by Stone Type

Emerald

Ruby

Sapphire

Other

by Product Type

Rings

Necklaces

Earrings

Bracelets

Chains and Pendants

Other

The India Gem and Jewellery Market has varying dominance across several product sectors based on product type. Due to its vast appeal and cultural significance in India, rings and necklaces stand out as the most popular categories, holding significant market shares in the country’s gem and jewelry business. Due of their cultural significance and ongoing demand, rings—especially engagement rings—dominate the Indian market. Deeply ingrained in Indian customs, these ornaments represent dedication and help explain their ongoing supremacy.

by Distribution Channel

Online

Offline

Click here for a more detailed explanation: https://www.maximizemarketresearch.com/request-sample/122565/

Key Players in India’s Gem and Jewellery Market

India’s gem and jewellery market is home to some of the world’s leading players, as well as numerous homegrown brands that cater to diverse consumer segments. Some of the most notable players in this market, as well as their recent activities, include:

- Tanishq (Titan Company): Tanishq remains one of India’s largest and most respected jewellery brands, renowned for its innovative designs and high-quality gems. Tanishq continues to expand its product lines, focusing on both traditional and contemporary jewellery. In 2024, Tanishq is exploring partnerships with global gem suppliers to source unique, high-quality diamonds and gemstones.

- Kalyan Jewellers: One of the largest jewellery retailers in India, Kalyan Jewellers has expanded its footprint both domestically and internationally. The brand has recently entered the Middle Eastern market, with plans to expand its luxury jewellery offerings.

- PC Jeweller: PC Jeweller is making waves with its e-commerce initiatives, particularly its online store. The brand is investing heavily in technological innovations, such as augmented reality to enhance the online shopping experience.

- Malabar Gold & Diamonds: Malabar Gold & Diamonds is one of India’s leading jewellery retailers, with a significant presence in the Middle East and Southeast Asia. The brand has been expanding its global presence through strategic acquisitions and partnerships.

- Zales: As a prominent US-based jewellery retailer with significant operations in India, Zales has strengthened its global presence with its recent acquisition of Kendra Scott. This strategic move allows Zales to offer a broader range of jewellery products, including fine gemstones and customizable pieces.

- JewelFever: JewelFever, a new entrant to the Indian jewellery market, is making a name for itself with its focus on lab-grown diamonds and sustainable jewellery. The company is leveraging its online platform to reach younger, more environmentally-conscious consumers.

Click here for a more detailed explanation: https://www.maximizemarketresearch.com/market-report/india-gem-jewellery-market/122565/

Discover the Game-Changers:

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Key Trends

- PESTLE Analysis and PORTER’s Five Forces Analysis

- Market Segmentation – A detailed analysis of segments and sub-segments

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

- Key Findings and Analyst Recommendations

Elevate your knowledge base with the most recent research trends curated by Maximize Market Research:

Elliptical Market https://www.maximizemarketresearch.com/market-report/global-elliptical-market/86812/

Global FRP Manhole Covers Market https://www.maximizemarketresearch.com/market-report/global-frp-manhole-covers-market/74461/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 9607195908, +91 9607365656

India’s Dishwashers Market Booming Demand, Key Mergers, and Latest Market Insights