India’s Dishwashers Market Continues to Grow in 2024

India’s dishwashers market is experiencing robust growth, driven by rising disposable incomes, changing lifestyles, and increasing consumer interest in home appliances. The demand for dishwashers is expanding across both urban and semi-urban areas as more households shift towards automation and convenience in daily chores. In 2024, several major mergers, acquisitions, and technological innovations are shaping the landscape, offering new opportunities for both international and local players.

Key Developments in India’s Dishwashers Market

The India dishwashers market is evolving with several significant trends, including a rise in demand for energy-efficient and compact models. As Indian consumers continue to embrace modern appliances, companies are responding with product innovations that meet both the need for affordability and advanced features. Additionally, the sector is witnessing an uptick in strategic mergers and acquisitions as global brands vie for market share.

Global Mergers and Acquisitions Impacting the Indian Market

Several mergers and acquisitions (M&A) have influenced the dishwashers market, especially from key regions such as the US, Europe, Japan, South Korea, Southeast Asia, and beyond. These deals are positioning major players to better serve the rapidly growing Indian market:

- Vietnam: In 2023, VietHome Appliances acquired a majority stake in VeroDish, a popular Vietnamese brand that manufactures energy-efficient dishwashers. This acquisition aims to enhance the brand’s presence in Southeast Asia and India, where demand for sustainable household appliances is on the rise.

- Thailand: Toshiba Thailand expanded its operations in India through the acquisition of DishMaster India, a local manufacturer of budget-friendly dishwashers. The deal positions Toshiba as a leading player in the affordable dishwasher segment in India, catering to the middle-class demographic.

- Singapore: Singapore-based Panasonic Asia acquired DishCare, a regional dishwasher brand, in 2024. This acquisition strengthens Panasonic’s market position in India, as the brand looks to introduce more premium and high-tech models to appeal to India’s growing urban middle class.

- Japan: Mitsubishi Electric has increased its footprint in India with the acquisition of EcoWash, a local Indian dishwasher manufacturer known for its energy-saving technology. This deal will help Mitsubishi leverage its global brand while focusing on offering more eco-friendly products for environmentally conscious consumers.

- South Korea: LG Electronics made headlines with its acquisition of DishEase India, a local competitor. The acquisition allows LG to gain a larger market share in India’s expanding dishwasher market, focusing on its advanced washing technology and smart home integration.

- United States: Whirlpool Corporation, a major player in the global home appliance industry, acquired KleanDish India, a prominent local brand, in early 2024. This acquisition aims to increase Whirlpool’s penetration in India’s premium dishwasher segment, which has seen rapid growth in recent years.

- European Union: Bosch Home Appliances, a leading German manufacturer, has significantly expanded its operations in India by acquiring CleanTech, an Indian appliance company focused on dishwashing. Bosch’s acquisition will help it strengthen its market dominance with a focus on energy-efficient, high-performance dishwashers.

India Dishwashers Market Scope:

by Product Type

Free-Standing Dishwashers

Built-In Dishwashers

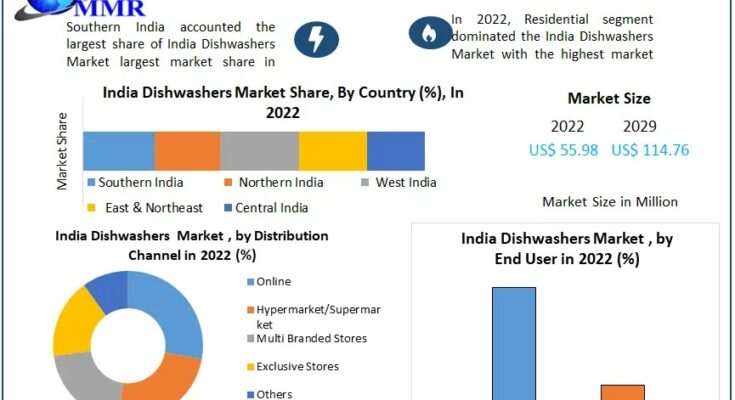

According to product type, the India dishwasher market’s free-standing dishwashers segment was the market leader in 2022. Freestanding dishwashers don’t need to be installed within cabinets; they may be positioned anywhere in the kitchen. Because of their versatility and ease of use, freestanding dishwashers have become quite popular in homes. Many customers choose these appliances because they provide the convenience of a dishwasher without requiring permanent installation. Freestanding dishwashers appeal to a broad spectrum of consumers who want flexible solutions. The simplicity of installation is one of the primary features that distinguish freestanding dishwashers.

by End User

Commercial

Residential

In 2022, the end-user segment of the Indian dishwasher market was led by the residential sector. The need for dishwashers in the residential sector is accelerated by shifting lifestyles, rising disposable incomes, and changing customer preferences. More people are using dishwashers because of their effectiveness, water-saving features, and hygienic benefits. Indian customers are investing in contemporary equipment that improve their everyday living conditions as a result of rising disposable incomes and desires for a more comfortable lifestyle. Dishwashers have come to represent efficiency and ease, fitting well with many households’ desired lifestyles. Making the most of available space is crucial in urban kitchens.

by Distribution Channel

Online

Hypermarket/Supermarket

Multi Branded Stores

Exclusive Stores

Others

Key Market Trends Shaping the India Dishwashers Market

Several key trends are driving the growth of India’s dishwashers market in 2024. These trends reflect evolving consumer preferences, technological innovations, and changing lifestyles:

1. Rising Demand for Energy-Efficient Dishwashers

As environmental awareness grows, Indian consumers are increasingly choosing energy-efficient dishwashers to reduce both energy consumption and water usage. Brands such as Bosch, LG, and Whirlpool are responding to this demand by introducing energy-saving models equipped with advanced technologies that minimize electricity and water consumption.

2. Smart Dishwashers and IoT Integration

Smart appliances are gaining popularity in Indian households. Dishwashers equipped with Internet of Things (IoT) capabilities allow consumers to control and monitor their appliances via mobile apps. Companies like Samsung and Whirlpool have introduced dishwashers that integrate with smart home ecosystems, enabling users to schedule wash cycles remotely, receive maintenance alerts, and more.

3. Compact and Modular Designs for Small Homes

With the increasing trend of smaller living spaces in India, particularly in metropolitan areas, compact and modular dishwashers are becoming more popular. These smaller units cater to urban families with limited kitchen space but still offer excellent cleaning performance. Several brands, including Siemens and IFB, have introduced compact models that fit the needs of modern Indian homes.

4. Growth of E-Commerce and Online Sales

The rise of e-commerce in India has contributed significantly to the growth of the dishwashers market. Consumers are increasingly purchasing dishwashers online, as e-commerce platforms provide greater access to product information, competitive prices, and home delivery. Companies are optimizing their online presence and offering direct-to-consumer sales through platforms like Amazon, Flipkart, and brand-specific websites.

Key Players and Latest Updates in India’s Dishwashers Market

India’s dishwashers market is dominated by several key international and domestic players, who are actively making strategic moves to maintain their market share and expand their reach.

- Bosch Home Appliances: Bosch continues to lead the Indian market with its energy-efficient, high-performance dishwashers. The company’s recent acquisition of CleanTech further solidifies its position in India, particularly in the premium segment.

- Whirlpool Corporation: Whirlpool’s recent acquisition of KleanDish India allows it to tap into the growing demand for affordable yet efficient dishwashers in India. The company is also known for its innovations in washing technology and smart features.

- LG Electronics: LG’s acquisition of DishEase India is a strategic move to consolidate its presence in India’s growing dishwasher market. LG’s focus on smart dishwashers and IoT integration is positioning it as a premium brand in the country.

- Samsung Electronics: Samsung continues to push the envelope with its high-tech dishwashers, offering features like Wi-Fi connectivity and eco-friendly wash programs. The company has seen significant success in urban areas, where tech-savvy consumers are driving demand for smart appliances.

- IFB Industries: Known for its high-quality dishwashers tailored to the Indian market, IFB is making strides by offering compact and modular units suited for small to medium-sized homes. The brand’s focus on customer service and product innovation has made it a strong player in India’s competitive market.

Discover the Game-Changers:

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Key Trends

- PESTLE Analysis and PORTER’s Five Forces Analysis

- Market Segmentation – A detailed analysis of segments and sub-segments

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

- Key Findings and Analyst Recommendations

Elevate your knowledge base with the most recent research trends curated by Maximize Market Research:

Global Bamboo Leaf Extract Market https://www.maximizemarketresearch.com/market-report/global-bamboo-leaf-extract-market/108439/

Global Benzotrichloride Market https://www.maximizemarketresearch.com/market-report/global-benzotrichloride-market/74900/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 9607195908, +91 9607365656

Global Cast Iron Cookware Market