Overview and Scope

An insurance chatbot is a specialized chatbot designed to assist users with insurance-related queries, tasks, and transactions. Using insurance chatbots ultimately leads to improved operational efficiency, enhanced customer satisfaction, and a more seamless interaction between insurance providers and policyholders.

Sizing and Forecast

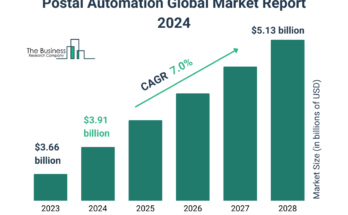

The insurance chatbot market size has grown exponentially in recent years. It will grow from $0.61 billion in 2023 to $0.77 billion in 2024 at a compound annual growth rate (CAGR) of 26.3%. The growth in the historic period can be attributed to focus on personalization, expansion of multichannel capabilities, increased use in claims processing, use of predictive analytics, integration with voice assistants.

The insurance chatbot market size is expected to see exponential growth in the next few years. It will grow to $1.94 billion in 2028 at a compound annual growth rate (CAGR) of 26.0%. The growth in the forecast period can be attributed to increasing customer expectations, cost efficiency and automation, rise of digital channels, enhanced customer engagement, rapid growth in insurtech. Major trends in the forecast period include continuous ai advancements, explainable ai (xai), dynamic scripting and adaptive conversations, ai-powered fraud detection, human augmentation in customer support.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/insurance-chatbot-global-market-report

Segmentation & Regional Insights

The insurance chatbot market covered in this report is segmented –

1) By Type: Customer Service Chatbots, Sales Chatbots, Claims Processing Chatbots, Underwriting Chatbots, Other Types

2) By User Interface: Text-based Interface, Voice-based Interface

3) By Platform: Web-based, Mobile-based

North America was the largest region in the insurance chatbot market in 2023. The regions covered in the insurance chatbot market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13682&type=smp

Major Driver Impacting Market Growth

The rising demand for automated services is expected to propel the growth of the insurance chatbot market going forward. Automated services refer to processes, tasks, or systems that operate and perform functions with minimal human intervention, relying on automation technologies, algorithms, and artificial intelligence to execute predefined actions or workflows. Insurance chatbots are virtual assistants powered by artificial intelligence (AI) that can automate various tasks and services for insurance companies and their customers. Automation allows insurance chatbots to handle routine tasks, provide real-time support, and contribute to a more seamless and responsive customer experience. For instance, in May 2023, according to Formstack, a US-based software company, around 76% of organizations employ automation to optimize their daily workflows, 58% utilize automation for data and reporting to facilitate planning, and 36% integrate automation to ensure compliance with regulations. Therefore, the rising demand for automated services is driving the growth of the insurance chatbot market.

Key Industry Players

Major companies operating in the insurance chatbot market report are Amazon.com Inc., International Business Machines Corporation, Allstate Corporation, Oracle Corporation, Geico, Nuance Communications, Verint Systems Inc., Userlike, Shift Technologies, LivePerson Inc., Lemonade , Yellow.ai, Boostlingo, Conversica, Ada Support Inc., ShareChat, Snapsheet, Insurify, Lexalytics Inc., Spixii, Chatfuel, Livegenic, Violet, Alphachat.ai, Sense360, Botsify, ManyChat, Engati, Inbenta Technologies Inc., SANA Benefits

The insurance chatbot market report table of contents includes:

1. Executive Summary

2. Insurance Chatbot Market Characteristics

3. Insurance Chatbot Market Trends And Strategies

4. Insurance Chatbot Market – Macro Economic Scenario

5. Global Insurance Chatbot Market Size and Growth

.

.

.

32. Global Insurance Chatbot Market Competitive Benchmarking

33. Global Insurance Chatbot Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Insurance Chatbot Market

35. Insurance Chatbot Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model