Livestock Insurance Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size –

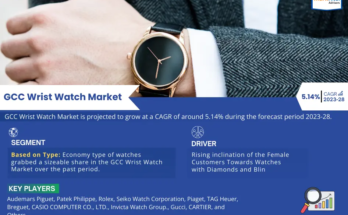

The livestock insurance market size has grown strongly in recent years. It will grow from $3.38 billion in 2023 to $3.66 billion in 2024 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to agricultural expansion and intensification, increased incidences of livestock diseases, adoption of risk management practices in agriculture, regulatory support, and economic stability.

The livestock insurance market size is expected to see strong growth in the next few years. It will grow to $5.02 billion in 2028 at a compound annual growth rate (CAGR) of 8.3%. The growth in the forecast period can be attributed to climate change impacts on disease patterns, globalization and animal movement regulations, growing awareness and adoption of livestock insurance, economic volatility, government support. Major trends in the forecast period include technological advancements, data analytics, blockchain for transparency, remote monitoring, collaboration and partnerships.

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/livestock-insurance-global-market-report

Scope Of Livestock Insurance Market

The Business Research Company’s reports encompass a wide range of information, including:

- Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

- Drivers: Examination of the key factors propelling market growth.

- Trends: Identification of emerging trends and patterns shaping the market landscape.

- Key Segments: Breakdown of the market into its primary segments and their respective performance.

- Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

- Macro Economic Factors: Assessment of broader economic elements impacting the market.

Livestock Insurance Market Overview

Market Drivers –

A surge in the number of diseases in livestock is expected to propel the growth of the livestock insurance market going forward. Livestock diseases refer to illnesses or health conditions that affect animals raised for agricultural, commercial, or personal purposes. The surge in the number of diseases in livestock is due to the intensification of farming practices, global movement of animals, and climate change impacting disease vectors and transmission patterns. Livestock insurance helps farmers mitigate financial losses from disease outbreaks by providing compensation for veterinary costs, loss of income, and other expenses related to managing and recovering from livestock diseases. For instance, in August 2022, according to the report by the World Organization for Animal Health (WAHIS), a global database of animal health, more than 1,125,000 pigs and 36,000 wild boars have been affected by African Swine Fever (ASF) since January 2020 (data reported through INs and FURs), resulting in more than 1,960,000 animal losses. Therefore, the surge in the number of diseases in livestock will drive the growth of the livestock insurance market.

Market Trends –

Major companies operating in the livestock insurance market are engaged in developing insurance products with multiple advantages, such as parametric heat-stress insurance, to offer more precise and responsive coverage options and expand market reach. Parametric heat-stress insurance for cattle pays out based on predefined weather conditions that indicate heat stress rather than actual losses experienced by the farmer. For instance, in May 2023, NFU Mutual, a UK-based rural insurer, in collaboration with Skyline Partners, a UK-based insurance company, along with Markel Group, a US-based specialty insurance provider, and Arthur J. Gallagher & Co., a US-based insurance broker, launched a pioneering parametric heat-stress insurance tailored for UK dairy farmers. This innovative coverage utilizes an index-based approach, providing predetermined payouts triggered by specific weather conditions monitored through satellite and weather station data, aiming to safeguard against financial losses due to heat stress in cattle.

The livestock insurance market covered in this report is segmented –

1) By Coverage: Mortality, Revenue, Other Coverage

2) By Animal Type: Bovine, Swine, Sheep And Goats, Poultry, Other Animals

3) By Distribution Channel: Direct, Agency Or Broker, Bancassurance, Other Distribution Channels

4) By End User: Commercial, Individuals

Get an inside scoop of the livestock insurance market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=16466&type=smp

Regional Insights –

North America was the largest region in the livestock insurance market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the livestock insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies –

Major companies operating in the livestock insurance market are <b>Allianz SE, Munich Reinsurance Company, Nationwide Mutual Insurance Company, Liberty Mutual Insurance Company, Swiss Reinsurance Company Ltd, Zurich Insurance Group Ltd., Chubb Limited, Sompo Holdings Inc., The Hartford Financial Services Group Inc., AXA XL, American Family Insurance, QBE Insurance Group Ltd., Shelter Insurance Companies, Lloyd’s of London, ICICI Lombard General Insurance Company Limited, Howden Insurance & Reinsurance Brokers (Philippines) Inc., HDFC ERGO General Insurance Company Limited, Farm Bureau Financial Services, Future Generali India Insurance Company Ltd., FBL Financial Group Inc., Rural Mutual Insurance Company, The Accel Group, Farmers Mutual Hail Insurance Company of Iowa, GramCover, The Bath State Bank.</b>

Table of Contents

- Executive Summary

- Livestock Insurance Market Report Structure

- Livestock Insurance Market Trends And Strategies

- Livestock Insurance Market – Macro Economic Scenario

- Livestock Insurance Market Size And Growth

…..

- Livestock Insurance Market Competitor Landscape And Company Profiles

- Key Mergers And Acquisitions

- Future Outlook and Potential Analysis

- Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model