The global Meter data management system Market was valued at USD 3.1 billion in 2022, and is projected to reach USD 7.2 billion by 2032 at a CAGR of 14.4% from 2022 to 2032. Meter Data Management System (MDMS) is a software application designed to manage data generated by smart meters, which are digital devices that measure electricity, gas, or water consumption in real-time. MDMS collects, validates, stores, and analyzes data from smart meters to enable utilities to optimize their operations, enhance customer service, and make informed decisions. The advantages of using a Meter Data Management System are numerous. Firstly, it enables utilities to accurately measure customer consumption patterns, identify usage trends, and predict future demand, allowing them to better manage their resources and reduce waste. Secondly, it provides real-time monitoring of system performance and the ability to quickly detect and respond to issues such as outages or leaks. Thirdly, it enhances customer engagement by providing them with timely and accurate information on their energy usage, bills, and the ability to participate in energy-saving programs. The adoption of Meter Data Management Systems has been driven by the increasing deployment of smart meters by utilities worldwide.

Smart grid technology and advanced metering infrastructure (AMI) are two related concepts that are transforming the way we generate, distribute, and consume energy. Smart grid technology refers to the integration of digital communication and automation technologies into the existing electricity grid. This includes the use of sensors, advanced analytics, and real-time data processing to optimize the generation, distribution, and consumption of electricity. Advanced metering infrastructure (AMI), also known as smart metering, is a key component of smart grid technology. AMI involves the deployment of advanced meters that can communicate with the grid in real-time, providing data on energy consumption, voltage levels, and other factors. This data can be used to optimize the grid, reduce energy waste, and improve the reliability of the system. The meter data management system (MDMS) market is growing due to the increasing adoption of smart meters and advanced metering infrastructure (AMI) across various end-use sectors.

By Component

• Software

• Service

• Electric Meters

• Gas Meters

• Water Meters

Geography:

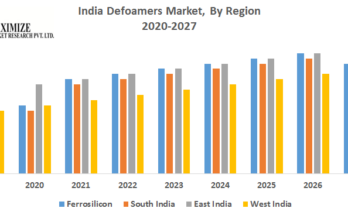

North America and Europe are expected to hold significant market shares due to the presence of several key players and the high adoption of advanced technologies in these regions. North America has been a pioneer in the development and deployment of smart grid technology. The region has been actively working to modernize its energy infrastructure, and smart grid technology has played a critical role in achieving this goal. In the United States, the Department of Energy has been working to promote the development and deployment of smart grid technology through its Smart Grid Investment Grant program, which provided funding for a range of smart grid projects across the country. The program helped to accelerate the deployment of advanced metering infrastructure (AMI), distribution automation, and other smart grid technologies. Such developments are anticipated to propel the market growth in the North American region.

The COVID-19 pandemic has significantly impacted the global economy, including the meter data management system market. The market has witnessed a decline in growth due to the disruptions caused by the pandemic, such as supply chain disruptions, reduced demand for energy, and decreased investments in infrastructure projects. According to a report by the International Energy Agency (IEA), the global electricity demand is estimated to decline by 2% in 2020 due to the COVID-19 pandemic, which has led to reduced industrial and commercial activities. This decline in demand for energy has affected the growth of the meter data management system market, as the demand for energy meters has reduced. However, the market is expected to recover and grow at a significant pace in the post-pandemic period. The demand for meter data management systems is expected to increase as countries focus on building a sustainable and resilient energy infrastructure that can handle future challenges.

Overall, while the COVID-19 pandemic has had a temporary negative impact on the meter data management system market, the market is expected to recover and grow in the post-pandemic period, driven by the increasing focus on sustainable and resilient energy infrastructure and the implementation of government policies and initiatives.

Impact of the Russia-Ukraine War on the global Meter data management system Market:

The meter data management system market is heavily reliant on the energy and utility sector, which in turn is affected by factors such as geopolitical tensions, economic sanctions, and trade policies. The Russia-Ukraine conflict has the potential to disrupt the energy sector and cause supply chain disruptions, which could impact the demand for meter data management systems. Furthermore, the ongoing conflict may also impact the investment climate in the region, leading to a slowdown in infrastructure development and technology adoption. This could affect the growth of the meter data management system market in the region. However, it is important to note that the impact of the Russia-Ukraine war on the meter data management system market may vary depending on the specific countries and companies involved in the market.

• Siemens AG

• Honeywell International Inc.

• Schneider Electric SE

• Itron Inc.

• Kamstrup A/S

• Landis+Gyr AG

• Diehl Stiftung & Co. KG

• Elster Group GmbH

• Aclara Technologies LLC

• Eaton Corporation

• IBM Corporation

• ABB Ltd.

• Oracle Corporation

• Cisco Systems Inc.

• Trilliant Holdings Inc.

Frequently Asked Questions About This Report

- How big is the Market?

- What is the Market growth?

- Which segment accounted for the largest Market share?

- Who are the key companies/players in the Market?

- What are the factors driving the Market?

- How has the Covid-19 pandemic affected the Market?

- What is the leading solution segment in the Market?

- What is the leading deployment segment in the Market?

- Which enterprise segment accounted for the largest revenue share in the Market?