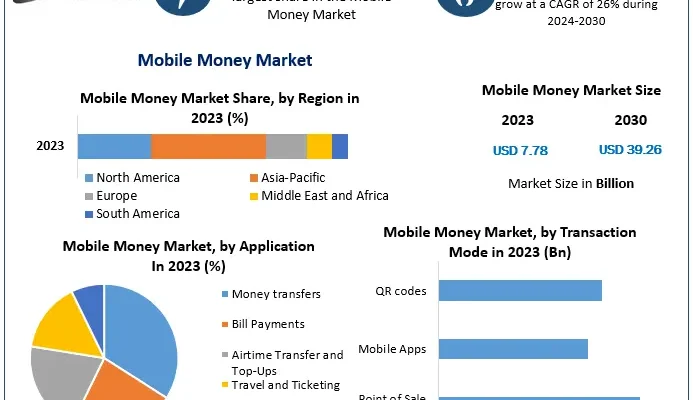

Mobile Money Market size was valued at US$ 7.78 Bn. in 2023 and the total revenue is expected to grow at 26 % through 2024 to 2030, reaching nearly US$ 39.26 Bn.

Mobile Money Market Overview:

The mobile money market has seen rapid growth in recent years, driven by the increasing adoption of smartphones, internet connectivity, and digital payment systems. Mobile money services allow consumers to make financial transactions such as payments, transfers, and bill settlements using their mobile devices, providing a convenient and accessible solution, especially in regions with limited access to traditional banking. The market includes mobile wallets, mobile banking, and mobile-based payment platforms, which have gained widespread acceptance in both developed and emerging markets. The growing trend of cashless transactions and the expansion of digital financial inclusion are key factors contributing to the market’s growth.

Get Free Access to Our Sample Report:https://www.maximizemarketresearch.com/request-sample/7166/

Mobile Money Market Trends:

A key trend in the mobile money market is the increasing integration of advanced technologies such as Artificial Intelligence (AI) and blockchain. AI is being used to improve security, personalize services, and enhance the customer experience. AI-driven chatbots, for instance, are being employed for customer support and to facilitate transactions, while blockchain offers enhanced transparency, security, and efficiency for cross-border payments. These technologies are significantly transforming how mobile money services are delivered and are expected to play an even larger role in the market as innovation continues to drive digital financial solutions.

What are Mobile Money Market Dynamics?

The mobile money market is primarily driven by factors such as the increasing penetration of smartphones, internet access, and the rising preference for cashless transactions. Mobile money provides a vital alternative to traditional banking services, especially in regions with low banking penetration. For example, in parts of Africa, mobile money services like M-Pesa have revolutionized the way people transfer money, access financial services, and make payments. This has led to widespread adoption in both urban and rural areas, where mobile phones are more common than traditional banking infrastructure. The market dynamics also include regulatory changes, with governments and financial authorities implementing frameworks to ensure mobile money platforms are secure, compliant with anti-money laundering laws, and accessible to a broader population.

Mobile Money Market Opportunities:

The mobile money market offers significant opportunities, particularly in emerging markets, where mobile financial services are crucial for financial inclusion. According to several studies, a large proportion of the global population remains unbanked, primarily in regions such as Africa, South Asia, and Latin America. Mobile money services offer these populations the ability to access essential financial services, including payments, money transfers, and loans. As mobile penetration continues to grow in these regions, there is vast potential for mobile money operators to expand their reach and offer innovative financial products tailored to local needs.

What is Mobile Money Market Regional Insight?

Regionally, the mobile money market is experiencing strong growth in areas like Africa, Asia-Pacific, and Latin America, where traditional banking infrastructure is lacking, and mobile penetration is high. In Africa, mobile money services like M-Pesa, Airtel Money, and MTN Mobile Money have revolutionized access to financial services, enabling millions of unbanked individuals to engage in digital financial transactions. In countries like Kenya and Nigeria, mobile money has become a critical tool for everyday transactions, from sending remittances to paying for goods and services. The market is expected to continue expanding in these regions, driven by increasing smartphone penetration, improved mobile network coverage, and innovative mobile payment solutions.

Get An Exclusive Sample Of The Mobile Money Market Report At This Link (Get The Higher Preference For Corporate Email ID): –https://www.maximizemarketresearch.com/request-sample/7166/

What is Mobile Money Market Segmentation?

by Payment Type

Remote Payments

Proximity Payments

by Industry

BFSI

Telecom and IT

Media and entertainment

Healthcare

Travel and hospitality

Transportation

Others

by Transaction Mode

Point of Sale (PoS)

Mobile Apps

QR codes

by Nature of Payment

Person to Person (P2P)

Person to Business (P2B)

Business to Person (B2P)

Business to Business (B2B)

by Application

Money transfers

Bill Payments

Airtime Transfer and Top-Ups

Travel and Ticketing

Merchandise and Coupons

Some of the current players in the Mobile Money Market are:

1. Vodafone

2. Google

3. Orange

4. FIS

5. PayPal

6. MasterCard

7. Fiserve

8. Airtel

9. Gemalto

10. Alipay

11. MTN

12. PAYTM

13. Samsung

14. VISA

15. Tencent

16. Global Payments

17. Square

18. Amazon

19. Apple

20. Western Union Holdings

21. Comviva

22. T- Mobile

Know More About The Report:https://www.maximizemarketresearch.com/market-report/global-mobile-money-market/7166/

Key Offerings:

- Past Market Size and Competitive Landscape

- Mobile Money Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Mobile Money Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

For additional reports on related topics, visit our website:

Small Drones Market https://www.maximizemarketresearch.com/market-report/small-drones-market/2756/

Mobile Application Development Market https://www.maximizemarketresearch.com/market-report/global-mobile-application-development-market/59015/

Global Antidepressant Market https://www.maximizemarketresearch.com/market-report/global-antidepressant-market/109273/

Global Enterprise Governance, Risk and Compliance Market https://www.maximizemarketresearch.com/market-report/global-enterprise-governance-risk-and-compliance-market/23389/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 [email protected]

🌐 www.maximizemarketresearch.com