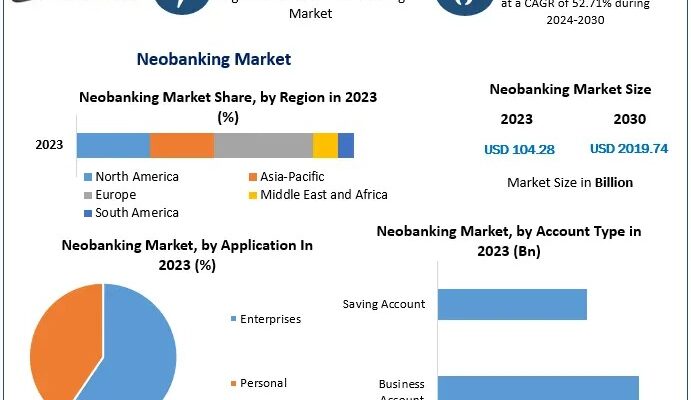

The Neobanking Market size was valued at USD 104.28 Bn. in 2023 and the total Neobanking revenue is expected to grow by 52.71 % from 2024 to 2030, reaching nearly USD 2019.74 Bn.

Neobanking Market Overview:

The neobanking market has evolved significantly in recent years, driven by the growing preference for digital-first financial services. Neobanks, which operate exclusively online without the traditional infrastructure of physical branches, have reshaped the banking landscape. With services available through mobile apps and web platforms, neobanks provide customers with the convenience of managing finances remotely, from checking balances to making transactions. These digital banks are often designed with modern consumers in mind, focusing on seamless user experiences and offering services like budgeting tools, real-time spending alerts, and low-fee financial products. Neobanks fall into two categories—those with a banking license and those without—yet they all share the ability to deliver innovative financial solutions that cater to the increasingly tech-savvy and convenience-oriented market.

What are Neobanking Market Dynamics?

One of the key drivers of the neobanking market is the ongoing digital transformation in the financial sector. As consumers increasingly prioritize convenience, the demand for fully digital banking solutions has risen sharply. Neobanks have capitalized on this trend by offering services that are available 24/7 and can be accessed from anywhere via mobile or desktop platforms. This flexibility appeals to users seeking more streamlined and accessible banking experiences, and the widespread adoption of smartphones has further fueled the growth of mobile-first banking. As a result, neobanks have been able to attract large numbers of customers, especially among younger generations who value digital-first services that align with their tech-driven lifestyles.

Curious About the Latest Trends? Get Your Free Sample Report Now:https://www.maximizemarketresearch.com/request-sample/222171/

Neobanking Market Trends:

One of the key trends shaping the neobanking market is the increased integration of advanced technologies like artificial intelligence (AI), machine learning, and data analytics. Neobanks are leveraging these technologies to provide users with more personalized and intuitive financial services. For example, AI-powered tools help users better understand their spending habits, provide insights on budgeting, and offer automated savings recommendations. This trend is particularly appealing to younger, tech-savvy consumers who expect their banking experiences to be intelligent, tailored, and user-friendly. As neobanks continue to innovate and refine their offerings, these technological advancements are expected to play a critical role in attracting and retaining customers.

Neobanking Market Opportunities:

The neobanking market presents significant opportunities for growth, particularly through partnerships and ecosystem-building strategies. By collaborating with fintech startups, technology providers, and other non-bank entities, neobanks can enhance their service offerings and create comprehensive financial ecosystems. These collaborations enable neobanks to offer a wider range of services, from investments to insurance, all within a single platform. Moreover, by integrating third-party applications, neobanks can provide an even more personalized experience, fostering customer loyalty and increasing user retention. This ecosystem approach also enables neobanks to scale their operations across borders, without the need for a physical presence, unlocking new markets and revenue streams.

What is Neobanking Market Regional Insight?

The regional insights into the neobanking market reveal that Europe has been the dominant region, accounting for a significant portion of global revenue in 2023. High smartphone penetration, a digitally inclined population, and a strong regulatory framework have all contributed to the region’s leadership in the neobanking space. European consumers are increasingly turning to neobanks for their innovative services, transparency, and user-friendly digital platforms, often perceiving traditional banks as outdated and slow to adapt to modern banking needs. The region’s established fintech ecosystem has also fostered innovation and helped to accelerate the adoption of digital-only banking services. As European neobanks continue to expand their offerings and enhance customer experience, the region is likely to maintain its lead in the global market for the foreseeable future.

Get An Exclusive Sample Of The Neobanking Market Report At This Link (Get The Higher Preference For Corporate Email ID): –https://www.maximizemarketresearch.com/request-sample/222171/

What is Neobanking Market Segmentation?

by Account Type

Business Account

Saving Account

by Service Type

Loans

Mobile Banking

Checking Saving Account

Payments and Money Transfer

Others

by Application

Enterprises

Personal

Some of the current players in the Neobanking Market are:

1. Cash App [United States]

2. Chime [United States]

3. Atom Bank PLC [United Kingdom]

4. KakaoBank [South Korea]

5. Monzo [United Kingdom]

6. Nubank [Brazil]

7. Revolut [United Kingdom]

8. Starling Bank [United Kingdom]

9. Stocard [Germany]

10. Tinkoff [Russia]

11. Venmo [United States]

12. Fidor Bank Ag [Germany]

13. Monzo Bank Limited [United Kingdom]

14. Movencorp Inc. [United States]

15. Mybank [China]

16. N26 [Germany]

17. Simple Finance Technology Corporation [United States]

18. Ubank Limited [Australia]

19. Webank, Inc. [China]

20. Pockit Ltd [United Kingdom]

21. PRETA S.A.S. [France]

Know More About The Report:https://www.maximizemarketresearch.com/market-report/neobanking-market/222171/

Key Offerings:

- Past Market Size and Competitive Landscape

- Neobanking Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Neobanking Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

For additional reports on related topics, visit our website:

Super Foods Market https://www.maximizemarketresearch.com/market-report/global-super-foods-market/97319/

Email Encryption Market https://www.maximizemarketresearch.com/market-report/global-email-encryption-market/28090/

Supercapacitor Market https://www.maximizemarketresearch.com/market-report/global-supercapacitor-market/57898/

Packaged Food Market https://www.maximizemarketresearch.com/market-report/packaged-food-market/122151/

Global Industrial Controls System Market https://www.maximizemarketresearch.com/market-report/global-industrial-controls-system-market/33096/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 [email protected]

🌐 www.maximizemarketresearch.com

Ceramic Armor Market Growth, Trends, and Future Opportunities 2024-2030