Europe Life Reinsurance Market Overview:

The study covers the global Europe Life Reinsurance market in depth, precisely, and completely, with a focus on market dynamics, market competition, regional growth, segmental analysis, and significant growth plans. Data on market growth, as well as market segmentation by regions, product type, application, and industry end-use, are included in the report. Experts provide detailed and exact marketing research reports using the most up-to-date Europe Life Reinsurance Market research techniques and technology. The Europe Life Reinsurance market size and share, as well as a wide range of industry verticals, are all thoroughly examined in this study.

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/189858

Europe Life Reinsurance Market Scope:

This study delves deeply into demand estimations, market trends, and micro and macro aspects. The aspects that are fueling and limiting the market’s growth are also highlighted in this report. The MMR Matrix in the study provides existing and new market participants with information on potential investment opportunities. The research employs analytical methodologies such as Porter’s five forces analysis and PESTLE of the Europe Life Reinsurance market to generate market insights. Current market trends and forecasts for the years 2023-2029 are also examined in the study. The research also identified significant upcoming developments that will affect demand over the predicted period.

Europe Life Reinsurance Market Dynamics:

The need for reinsurance protection to fund their expansion is expanding along with the demand for life insurance. The growing requirement for life insurance coverage is a result of increased financial protection awareness, rising incomes, and the necessity of retirement preparation. By providing reinsurance capacity, reinsurers aid in the growth of life insurers. Life insurers work to reduce their exposure to a variety of risks, including longevity, morbidity, and mortality risks. By shielding them from losses in those areas, life reinsurance businesses assist life insurance companies in entering new markets. The demand for the Europe life reinsurance market has increased as a result.

Europe Life Reinsurance Market Segmentation:

by Type

1.Facultative Reinsurance

2.Treaty Reinsurance

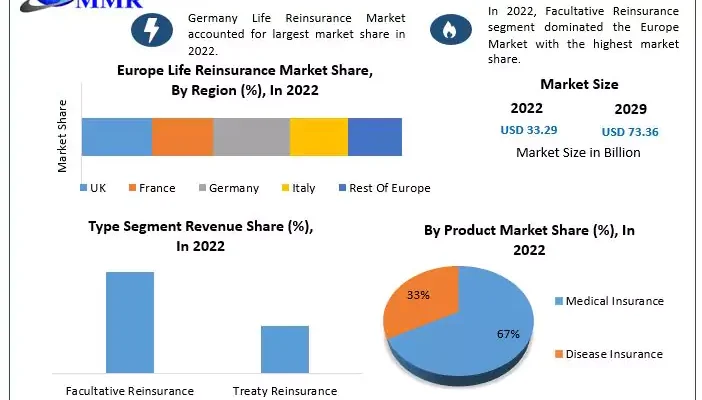

Life reinsurance is divided into Facultative reinsurance and Treaty reinsurance according to kind.

The facultative sector assists Life Reinsurance Company with risk analysis and selection of accepted or rejected risks. Due to the flexibility of the policy, facultative reinsurance is frequently employed for high-value or dangerous risks. A study done by an insurer to cover only risks or a group of risks taken into account in the insurer’s book of business is known as facultative reinsurance. As a result, the segment of facultative reinsurance led the market for life insurance in Europe, and this trend is anticipated to hold during the projected period.

by Product

1.Disease Insurance

2.Medical Insurance

The disease insurance and medical insurance product segments make up the Europe Life Reinsurance Market.

With a significant market share of 67.19%, the medical insurance category rules the Europe Life Reinsurance Market. This is so because a variety of medical costs, including as doctor visits, hospital stays, and prescription medications, are covered by medical insurance. The ageing population, the rising prevalence of chronic diseases, and the rising expense of healthcare are a few of the factors that are fueling the expansion of the medical insurance market. Typically, medical insurance premiums are less expensive than rates for illness insurance. This is so that a greater range of medical expenses can be covered by medical insurance, which is a more complete offering. Because of this, the life reinsurance market segment is dominated by medical insurance.

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/189858

Europe Life Reinsurance Market Key Players:

1.AXIS

2. GIC Re

3. Great-West Lifeco

4.Hannover Re

5. Lloydâs

6.Mapfre

7. Munich Re

8.Swiss Re

9.XL Catlin

For any Queries Linked with the Report, Ask an Analyst@ https://www.maximizemarketresearch.com/market-report/europe-life-reinsurance-market/189858/

Regional Analysis:

Thanks to the geographical insights in the reports, readers will be well-informed on the Europe Life Reinsurance market on a regional level. A detailed awareness of local energy, economic, political, and geographic factors is required for any meaningful assessment of potential policy options in response to global market change. The study provides readers with regional perspectives on Europe Life Reinsurance market and local growth potential, as well as domestic area restraints.

- Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

- Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

- North America (the United States, Mexico, and Canada.)

- South America (Brazil etc.)

- The Middle East and Africa (GCC Countries and Egypt.)

COVID-19 Impact Analysis on Europe Life Reinsurance Market:

The impact of COVID-19 on the market is thoroughly examined in the Europe Life Reinsurance market research. As a result of the COVID-19 problem, researchers at Maximize Market Research, who are following the situation across the globe, believe that the market will provide profitable opportunities for producers. The report’s purpose is to provide a more comprehensive view of the current situation, the economic downturn, and the influence of COVID-19 on the entire industry.

The research provides data-driven insights and recommendations on a variety of topics. The following are some of the most significant inquiries:

- What are the major current developments that could affect the product’s life cycle and return on investment?

- What are the implications of regulatory changes on corporate, business, and functional strategies?

- Will the micromarketing efforts of the main players result in investment?

- What are the best frameworks and methodologies for PESTLE analysis?

- In what areas will there be more new opportunities?

- What are the game-changing technologies that will be used to capture new revenue streams in the near future?

- How can various players develop client loyalty utilising distinct operational and tactical frameworks?

- What is the current and expected degree of market competition in the near future?