Middle East and Africa Life Reinsurance Market Overview:

This Middle East and Africa Life Reinsurance industry research provided a comprehensive analysis of the worldwide Middle East and Africa Life Reinsurance Market, taking into account all critical variables such as growth factors, limitations, market advancements, top investment pockets, future prospects, and trends. The research begins by emphasizing the important trends and possibilities that may develop in the near future and have a favorable influence on overall industry growth.

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/189585

Middle East and Africa Life Reinsurance Market Dynamics:

Due to their young and growing populations, the Middle East and Africa have a greater pool of potential life insurance policyholders. Life insurance is becoming more and more necessary as a measure of long-term planning and financial security as more people join the workforce and have families. The ability of primary insurers to meet this rising demand is greatly aided by reinsurers. Rapid infrastructure development is taking place in several Middle Eastern and African nations, including expenditures on healthcare, education, and transportation.

Middle East and Africa Life Reinsurance Market Scope:

The Middle East and Africa Life Reinsurance market report presents insights into each of the leading Middle East and Africa Life Reinsurance Market end users along with annual forecasts to 2027. The report provides a revenue forecast with sales and growth rate of the global Middle East and Africa Life Reinsurance Market. Forecasts are also provided for the market’s product, application, and geographic segments. Forecasts are produced to help people understand the industry’s future outlook and potential.

Middle East and Africa Life Reinsurance Segmentation:

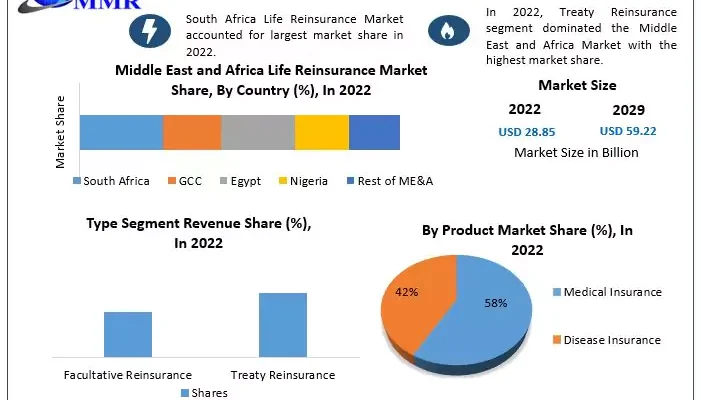

by Type

• Facultative Reinsurance

• Treaty Reinsurance

In the life reinsurance market, facultative reinsurance is subordinate to the treaty reinsurance segment. In a treaty reinsurance arrangement, a ceding company transfers to a reinsurer all risks associated with a given book of business. By doing this, the main insurer transfers all of the risk associated with its commercial car or residential insurance portfolios to the reinsurer. The reinsurer agrees to accept all covered business issued by the primary insurance company under a long-term agreement, or treaty, between the two parties. The agreement covers all existing policies from the ceding firm as well as any future policies that fall under the pre-established parameters of risk class specified in the treaty. This enables the reinsurance company to remain stable and consistent. In contrast to facultative systems.

by Product

• Disease Insurance

• Medical Insurance

The Middle East and Africa Life Reinsurance Market is divided into two product categories, Disease Insurance and Medical Insurance.

With a sizable market share, medical insurance leads the Middle East and Africa Life Reinsurance Market. This is so because a variety of medical costs, including as doctor visits, hospital stays, and prescription medications, are covered by medical insurance. Typically, medical insurance premiums are less expensive than rates for illness insurance. This is so that a greater range of medical expenses can be covered by medical insurance, which is a more complete offering. Compared to disease insurance, medical insurance is more affordable. This is due to the fact that there are more illness insurance businesses than there are medical insurance companies selling medical insurance products. Compared to sickness insurance, medical insurance is more inexpensive and comprehensive. This is why the market for medical insurance.

by Distribution Channel

• Direct Writing

• Agent and Broker

• Bank

by Category

• Recurring reinsurance

• Portfolio reinsurance

• Retrocession reinsurance

by End-Users

• Children

• Adults

• Senior Citizens

For detail insights on this market, request for methodology here@ https://www.maximizemarketresearch.com/request-sample/189585

Middle East and Africa Life Reinsurance Key Players:

The research includes the most recent news and industry developments in terms of Middle East and Africa Life Reinsurance Market expansions, acquisitions, growth strategies, joint ventures and collaborations, product launches, market expansions, and so on. Among the main companies in the Middle East and Africa Life Reinsurance Market sector are

• RGA Reinsurance Company

• African Reinsurance Corporation

• Arch Capital Group Ltd.

• Everest Re Group, Ltd.

• Guy Carpenter & Company, LLC

• OdysseyRe.

• Aon plc

• Mitsui Sumitomo Insurance Co., Ltd

For any Queries Linked with the Report, Ask an Analyst@ https://www.maximizemarketresearch.com/market-report/middle-east-and-africa-life-reinsurance-market/189585/

Regional Analysis:

The primary goal of this study is to assist the user in understanding the market in terms of definition, segmentation, market potential, significant trends, and the problems that the industry is experiencing across ten key regions.

COVID-19 Impact Analysis on Middle East and Africa Life Reinsurance Market:

The research details the overall impact of COVID-19 on the Middle East and Africa Life Reinsurance Market by providing a micro- and macroeconomic analysis. The precise study focuses on market share and size, which clearly depicts the impact that the pandemic has had and is anticipated to have on the global Health Insurance Market in the future years.

Key Questions aAnsweredin the Middle East and Africa Life Reinsurance Market Report are:

- What is the function of Middle East and Africa Life Reinsurance?

- What is the predicted revenue generation of the Middle East and Africa Life Reinsurance market?

- At what growth rate is the Middle East and Africa Life Reinsurance market evolving?

- Who are the major market giants operating in the Middle East and Africa Life Reinsurance market?

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Our Address

- MAXIMIZE MARKET RESEARCH PVT. LTD.

- ⮝ 444 West Lake Street, Floor 17,

- Chicago, IL, 60606, USA.

- ✆ +1 800 507 4489

- ✆ +91 9607365656

- 🖂 [email protected]

- www.maximizemarketresearch.com