Risk Analytics Market Report Overview

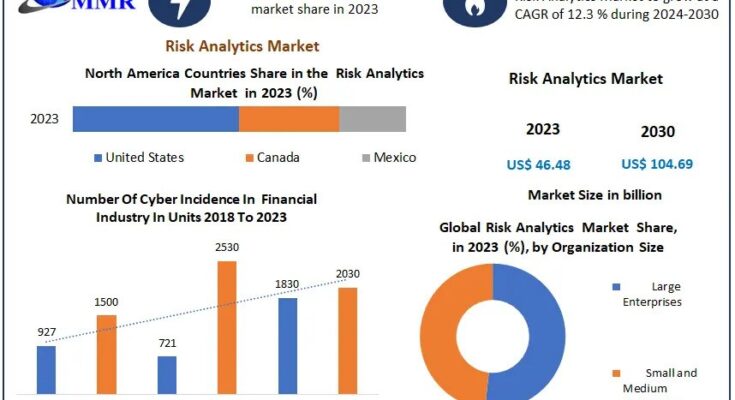

The global Risk Analytics Market is rapidly evolving, fueled by advancements in data analytics, machine learning, and computing power. Valued at USD 46.48 billion in 2023, the market is set to grow at a CAGR of 12.3%, reaching USD 104.69 billion by 2030. This growth reflects the increasing importance of risk management across industries, especially in the banking, finance, and insurance sectors.

To Learn More About This Study, Please Click Here: https://www.maximizemarketresearch.com/request-sample/62827/

Technological Advancements Drive Risk Analytics Growth: How Machine Learning and AI are Revolutionizing Risk Management

Technological innovations, particularly in machine learning and artificial intelligence, are revolutionizing how businesses approach risk management. Financial institutions, including banks, are leveraging these tools to analyze vast amounts of data in real time, predict risks, and make more informed decisions. The ability to integrate both structured and unstructured data has enhanced banks’ capabilities in credit risk modeling and operational risk management.

Key Players in the Risk Analytics Market: Leading Companies Across North America, Europe, and Asia-Pacific

Several key players are driving the growth of the Risk Analytics Market across various regions. In North America, SAS Institute Inc., IBM Corporation, and FICO are at the forefront. In Europe, firms like Aon plc and SAP SE lead the market, while in Asia-Pacific, SAI Global and Protecht Group are making significant strides in delivering innovative risk management solutions.

Mergers & Acquisitions in the Risk Analytics Market: Key Consolidations and Strategic Partnerships

Recent mergers and acquisitions in the Risk Analytics Market highlight the ongoing consolidation within the industry. Companies are seeking to enhance their technological capabilities and expand their geographic reach. These strategic moves are aimed at providing comprehensive and scalable solutions to meet the growing demand for advanced risk management tools across various sectors.

Regulatory Compliance Challenges: How the Evolving Legal Landscape Impacts Risk Analytics

While the growth of the Risk Analytics Market is undeniable, regulatory compliance remains a significant challenge. Regulations like Basel III and GDPR demand rigorous risk management frameworks and data protection measures. This often diverts resources from the adoption of advanced risk analytics tools, especially for smaller players in the market. Nevertheless, the market is evolving to include features that streamline compliance, helping organizations meet these challenges more efficiently.

Data Proliferation: The Untapped Opportunity for Risk Analytics in the Digital Age

With the proliferation of data, there is a lucrative growth opportunity for risk analytics solutions. Every piece of data holds the potential for new insights, enabling businesses to not only avoid risks but also capitalize on opportunities. By harnessing advanced predictive tools, financial institutions, retailers, and other businesses can stay ahead of emerging risks and maximize their opportunities.

To delve deeper into this research, please follow this link: https://www.maximizemarketresearch.com/request-sample/62827/

Risk Analytics Market Segmentation

by Component

Solution

Services

In 2023, the solution segment led the risk analytics market based on components. In order to effectively manage and mitigate risks, firms must adapt to changing demands. Risk analytics providers offer a broad range of solutions, from software platforms to consultancy services, that are designed to meet the needs of various industry sectors and risk situations. the growing variety and complexity of hazards that firms must deal with in the fast-paced commercial environment of today. Businesses need comprehensive and adaptable solutions to confidently traverse these complexity, which range from cybersecurity threats to regulatory compliance problems.

by Deployment

Cloud

On-premises

by Organization Size

Large Enterprises

Small and Medium-sized enterprises

by Risk Type

Strategic Risk

Operational Risk

Financial Risk

Reputational risk

Others

by Vertical

Banking & Financial Services

Insurance

Manufacturing

Transportation & Logistics

Retail & Consumer Goods

IT & Telecom

Government & Defense

Healthcare & Life Sciences

Energy & Utilities

According to Vertical, the risk analytics market in 2023 was dominated by the banking and financial sector. Because of the highly regulated environment in which they operate, financial institutions need robust risk management frameworks to guarantee stability and compliance. These firms can effectively navigate difficult regulatory environments with the help of risk analytics technologies. Credit, market, operational, and cyber risks are among the many and constantly changing hazards that the banking industry must deal with. Risk analytics provides customized solutions to efficiently detect, evaluate, and reduce these risks, protecting resources and enhancing efficiency.

For an in-depth analysis, click the provided link: https://www.maximizemarketresearch.com/request-sample/62827/

Risk Analytics Market Key Players

North America

1. SAS Institute Inc. – Cary, North Carolina, USA

2. IBM Corporation – Armonk, New York, USA

3. Oracle Corporation – Redwood City, California, USA

4. FICO (Fair Isaac Corporation) – San Jose, California, USA

5. Moody’s Analytics – New York, New York, USA

6. Verisk Analytics, Inc. – Jersey City, New Jersey, USA

7. Deloitte – New York, New York, USA

8. Quantitative Risk Management (QRM) – Chicago, Illinois, USA

9. RiskLens – Spokane, Washington, USA

10. Riskonnect, Inc. – Kennesaw, Georgia, USA

11. Resolver Inc. – Toronto, Ontario, Canada

12. MetricStream Inc. – San Jose, California, USA

Europe

1. Aon plc – London, United Kingdom

2. SAP SE – Walldorf, Germany

3. KPMG International – Amstelveen, Netherlands

4. PwC (PricewaterhouseCoopers) – London, United Kingdom

5. EY (Ernst & Young Global Limited) – London, United Kingdom

6. Wolters Kluwer – Alphen aan den Rijn, Netherlands

Asia Pacific

1. SAI Global – Sydney, Australia

2. Protecht Group – Sydney, Australia

Click here for additional information about this study : https://www.maximizemarketresearch.com/market-report/global-risk-analytics-market/62827/

Key questions answered in the Risk Analytics Market are:

- What is Risk Analytics?

- Who are the leading companies and what are their portfolios in Risk Analytics Market?

- What segments are covered in the Risk Analytics Market?

- Who are the key players in the Risk Analytics market?

- Which application holds the highest potential in the Risk Analytics market?

- What are the key challenges and opportunities in the Risk Analytics market?

- What growth strategies are the players considering to increase their presence in Risk Analytics?

- What is the growth rate of the Risk Analytics Market?

- Which are the factors expected to drive the Risk Analytics market growth?

- What are the upcoming industry applications and trends for the Risk Analytics Market?

- What will be the CAGR at which the Risk Analytics market will grow?

- What are the different segments of the Risk Analytics Market?

Key Offerings:

- Market Share, Size & Forecast by Revenue

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Key Trends

- Market Segmentation – A detailed analysis of segments and sub-segments

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Look Through Our Most Popular Reports:

Pregabalin Market https://www.maximizemarketresearch.com/market-report/global-pregabalin-market/109027/

Green and Bio Polyols Market https://www.maximizemarketresearch.com/market-report/green-and-bio-polyols-market/147933/

Global Water-Based Coatings Market https://www.maximizemarketresearch.com/market-report/global-water-based-coatings-market/70038/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656