Introduction: Key Trends and Growth in the Supply Chain Finance Market

The global supply chain finance (SCF) market is undergoing significant transformation, driven by technological advancements, strategic mergers and acquisitions, and a surge in demand for financial solutions that optimize supply chain operations. With a projected compound annual growth rate (CAGR) of 22.6% through 2030, the SCF market is seeing an influx of new players and collaborative ventures that enhance efficiency, improve cash flow, and provide seamless financial solutions. Key players, especially in regions like Vietnam, South Korea, Japan, the US, and Europe, are at the forefront of these developments.

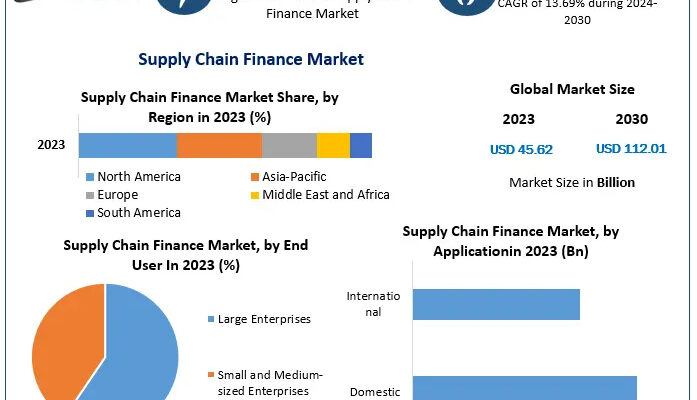

Estimated Growth Rate for Supply Chain Finance Market:

Supply Chain Finance Market size was valued at US$ 18.57 Bn. in 2023 globally and revenue is expected to grow at 23.25 % from 2024 to 2030, reaching nearly US$ 80.24 Bn.

Get your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/168082/

Mergers and Acquisitions in the Supply Chain Finance Market

Recent mergers and acquisitions in the supply chain finance industry highlight a trend toward consolidation and innovation. Leading companies are increasingly forming alliances to expand their service offerings and enhance their technological capabilities. Here are some notable M&A activities in the global market:

- Vietnam and Thailand: Vietnamese financial tech company Fintech Vietnam recently acquired SupplyChainPro in Thailand, enhancing its position as a regional leader in supply chain finance platforms. The acquisition is expected to streamline cross-border transactions and expand access to working capital solutions for SMEs.

- Singapore and Japan: Japanese giant Mizuho Bank acquired a minority stake in Singapore-based FinSupply Solutions, a move aimed at enhancing cross-border SCF capabilities between Asia and other global regions. This strategic partnership brings advanced AI-driven financial solutions to the market.

- South Korea: Korea’s leading fintech firm, SeoulSCF, recently merged with GlobalPay Solutions, a US-based SCF player, expanding its reach across both North America and Asia. This merger enables them to offer end-to-end supply chain financing solutions, including trade credit, invoice factoring, and dynamic discounting.

- United States: In the U.S., GlobalTech SCF, a financial technology firm, recently acquired TradeX to provide next-generation digital supply chain finance solutions for e-commerce companies. This move is expected to enhance supply chain visibility and reduce the cost of capital for customers.

- European Expansion: In Europe, EuroSupply Finance, a Luxembourg-based firm, has merged with BankingTech Solutions of Germany. The merger consolidates their expertise in managing cross-border trade finance and strengthens their position within the European market.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/168082/

Key Developments and Market Trends

- Technological Innovations Driving Efficiency: In response to growing demand for streamlined financial solutions, leading supply chain finance platforms are investing in AI and blockchain technology to automate invoice processing, improve risk management, and accelerate payment cycles. Companies like Tradeshift, Taulia, and C2FO are integrating these technologies into their platforms to offer scalable, data-driven solutions to businesses of all sizes.

- Sustainability in Supply Chain Finance: More companies are turning to sustainable finance solutions as part of their supply chain strategies. In the past year, FinGlobal, a South Korean SCF firm, launched a green financing option aimed at companies looking to offset carbon emissions while optimizing their supply chain operations.

- Growth of SCF Solutions for SMEs: Small and medium enterprises (SMEs) across Asia, including Vietnam and Thailand, are increasingly turning to supply chain finance as a way to access much-needed working capital. The low-cost structure and flexible repayment terms of SCF solutions make them an attractive option for small businesses that lack access to traditional financing methods.

- Regulatory Developments in the US and Europe: The U.S. and European Union are tightening regulations around supply chain finance to ensure greater transparency, combat fraud, and protect stakeholders. New rules are set to be introduced in 2024 to govern invoice discounting and securitization processes.

Inquire for More Details: https://www.maximizemarketresearch.com/request-sample/168082/

Regional Focus: Key Markets in 2024

- Vietnam: The SCF market in Vietnam is set to grow rapidly due to the country’s fast-developing manufacturing and export sectors. Vietnam’s government is also encouraging digital finance solutions, which is driving innovation in SCF platforms.

- Thailand: Thailand’s fintech ecosystem has exploded in recent years, and SCF is a key component of this growth. Thai businesses are increasingly adopting SCF solutions as they seek to enhance supply chain efficiency and liquidity.

- Singapore: Singapore remains a hub for SCF innovation, with major investments flowing into financial technology firms. The country’s strong regulatory framework and advanced banking infrastructure make it a favorable market for SCF providers.

- Japan and South Korea: Both countries are investing heavily in digital transformation across industries. SCF solutions are gaining popularity as companies seek faster and more flexible payment options. Japan’s government is also exploring regulatory changes to promote SCF adoption in the corporate sector.

- European Union and the U.S.: Both regions are pushing for greater integration of supply chain finance into the broader financial ecosystem. Companies are increasingly turning to SCF to manage risks, optimize cash flow, and improve their supplier relationships.

Supply Chain Finance Market Key Players are:

• IBM

• Ripple

• Rubix by Deloitte

• Accenture

• Distributed Ledger Technologies

• Oklink

• Nasdaq Linq

• Oracle

• AWS

• Citi Bank

• ELayaway

Conclusion: The Future of the Supply Chain Finance Market

With increasing technological innovation, regulatory changes, and strategic mergers and acquisitions, the global supply chain finance market is expected to continue its robust growth in the coming years. As regions like Vietnam, Thailand, South Korea, and the U.S. invest heavily in digital finance solutions, businesses across industries will benefit from greater liquidity, more efficient operations, and enhanced supply chain resilience.

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

[email protected]

+91 96071 95908, +91 9607365656

Discover What’s Trending:

Trekking Poles Market https://www.maximizemarketresearch.com/market-report/trekking-poles-market/218798/

Global Kitchenware Market https://www.maximizemarketresearch.com/market-report/global-kitchenware-market/77717/

Electronic Data Interchange (EDI) Market https://www.maximizemarketresearch.com/market-report/global-electronic-data-interchange-edi-market/90413/

India Packaging Market https://www.maximizemarketresearch.com/market-report/india-packaging-market/110868/

Global Sports Mouth Guard Market https://www.maximizemarketresearch.com/market-report/global-sports-mouth-guard-market/70068/

Mechanical Keyboard Market https://www.maximizemarketresearch.com/market-report/global-mechanical-keyboard-market/54554/

Titanium Market https://www.maximizemarketresearch.com/market-report/titanium-market/126890/

Energy Transition Market https://www.maximizemarketresearch.com/market-report/energy-transition-market/191270/

Large Format Printer Market https://www.maximizemarketresearch.com/market-report/large-format-printer-market/2500/

Hydrogel Market https://www.maximizemarketresearch.com/market-report/global-hydrogel-market/30928/