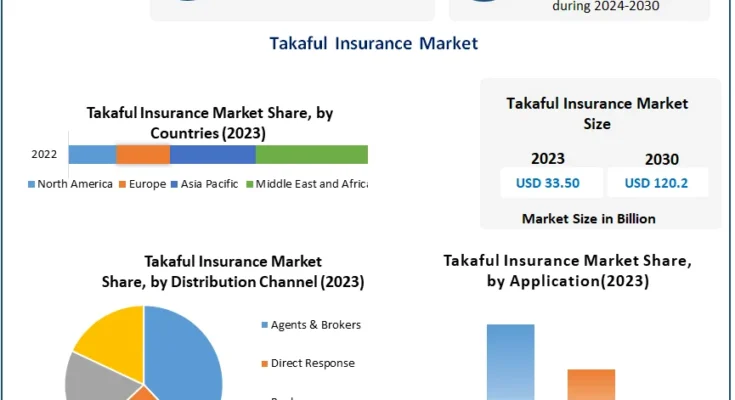

Global Takaful Insurance Market size was valued at USD 33.50 Bn. in 2023 and the total Takaful Insurance Market revenue is expected to grow by 15.1% from 2024 to 2030, reaching nearly USD 120.2 Bn.

Takaful Insurance Market Overview:

The Takaful insurance market is experiencing steady growth as more individuals and businesses seek Sharia-compliant insurance solutions. Takaful operates on the principles of mutual cooperation and shared responsibility, offering an ethical alternative to conventional insurance models. Its popularity is driven by the increasing awareness of Islamic financial principles and the rising demand for financial products that align with cultural and religious values. This market caters not only to Muslim-majority countries but also to a growing segment of non-Muslim populations seeking ethical financial options.

Get Free Access to Our Sample Report: https://www.maximizemarketresearch.com/request-sample/213737/

Takaful Insurance Market Trends:

One key trend in the Takaful insurance market is the integration of digital technologies to enhance customer experience and streamline operations. Insurtech solutions such as mobile apps, blockchain, and AI-driven analytics are being increasingly adopted to improve transparency, efficiency, and accessibility of Takaful products. These innovations are reshaping the market, attracting tech-savvy customers and facilitating the faster processing of claims and policies.

What are Takaful Insurance Market Dynamics?

The Takaful insurance market is driven by the increasing demand for ethical and Sharia-compliant financial solutions. The principles of risk-sharing and mutual assistance resonate strongly with customers seeking transparency and fairness in financial dealings. Additionally, supportive government regulations in Islamic countries and incentives for adopting Sharia-compliant models are fostering market growth.

Takaful Insurance Market Opportunities:

One major opportunity in the Takaful insurance market lies in developing customized products tailored to specific demographics and industries. For instance, micro-Takaful products targeting low-income groups can address the gap in financial inclusion, particularly in developing economies. Similarly, innovative products like family Takaful and retirement plans present untapped potential to meet the evolving needs of customers.

What is Takaful Insurance Market Regional Insight?

The Middle East and Southeast Asia dominate the Takaful insurance market due to their large Muslim populations and established regulatory frameworks supporting Sharia-compliant financial products. Countries like Saudi Arabia, Malaysia, and Indonesia lead in market share, benefiting from strong government backing and cultural acceptance of Takaful principles. These regions also continue to innovate by expanding their Takaful offerings into new sectors such as health and education.

Get An Exclusive Sample Of The Takaful Insurance Market Report At This Link (Get The Higher Preference For Corporate Email ID):https://www.maximizemarketresearch.com/request-sample/213737/

What is Takaful Insurance Market Segmentation?

by Type

Family

General

by Distribution Channel

Agents & Brokers

Direct Response

Banks

Others

by Application

Personal

Commercial

Some of the current players in the Takaful Insurance Market are:

1. Abu Dhabi National Takaful Co. [Abu Dhabi, United Arab Emirates]

2. Allianz

3. AMAN Insurance

4. Islamic Insurance

5. Prudential BSN Takaful Berhad

6. Qatar Islamic Insurance [Doha, Qatar]

7. SALAMA Islamic Arab Insurance Company

8. Syarikat Takaful Brunei Darussalam

9. Takaful International

10. Zurich Malaysia

11. HSBC Insurance

12. AIG Prudential

13. Tokio Marine

Know More About The Report:https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

Key Offerings:

- Past Market Size and Competitive Landscape

- Takaful Insurance Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Takaful Insurance Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

For additional reports on related topics, visit our website:

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com