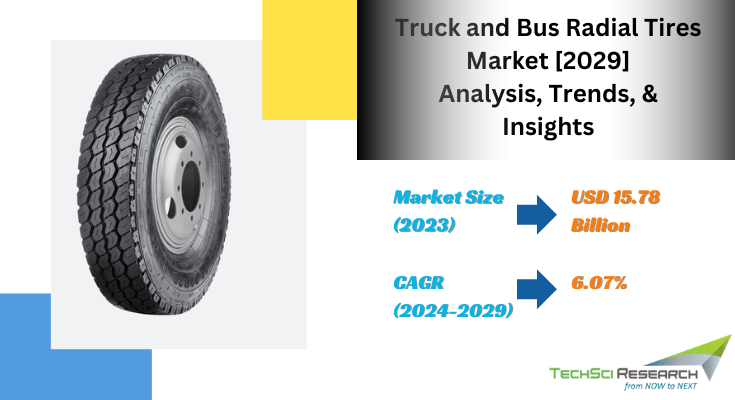

According to TechSci Research report, “Global Truck and Bus Radial Tires Market – Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the Global Truck and Bus Radial Tires Market stood at USD 15.78 Billion in 2023 and is anticipated to grow with a CAGR of 6.07% in the forecast period, 2025-2029. The global Truck and Bus Radial (TBR) Tire market has experienced remarkable growth in recent years, and this upward trajectory is projected to persist in the coming years.

The market expansion is primarily fueled by the ever-increasing demand for heavy-duty vehicles, especially in rapidly developing economies that are witnessing infrastructure advancements and economic growth. As industries continue to expand and logistics networks become more robust, the demand for TBR tires is expected to surge, providing lucrative opportunities for manufacturers and suppliers operating in this sector.

With their superior durability, enhanced fuel efficiency, and excellent load-bearing capabilities, TBR tires are becoming the preferred choice for fleet operators and transportation companies worldwide. The continued advancements in tire technology and the emphasis on sustainable mobility solutions are further driving the growth of the global TBR tire market, making it a dynamic and promising industry to watch out for.

The TBR tire industry is a fiercely competitive market, with numerous players vying for market dominance. Among the major companies in this industry are Bridgestone Corporation, Michelin, Goodyear, and Continental AG. These companies are renowned for their tire manufacturing expertise and engage in continuous research and development activities. Their tire innovations focus on producing advanced TBR tires that offer not only superior durability, performance, and fuel efficiency but also enhanced traction, braking, and handling capabilities. By pushing the boundaries of tire technology, these companies strive to meet the evolving needs of consumers and provide them with the best possible driving experience.

Globally, the Asia-Pacific region holds the largest market share for TBR tires, primarily due to the rapid industrialization and urbanization in countries like China and India. The rise in demand for commercial vehicles due to increased freight transportation and infrastructure development projects, coupled with the growing number of tire manufacturers in the region, has fueled the TBR tire market growth in Asia-Pacific.

Despite a temporary slowdown due to the COVID-19 pandemic and ensuing supply chain disruptions, the TBR tire market is gradually rebounding, thanks to the resumption of activities across the commercial vehicle sectors. However, the volatile raw material prices and stringent environmental regulations remain significant challenges to the TBR tire industry.

Emerging trends in the TBR (Truck and Bus Radial) tire market are opening up new and exciting opportunities for market expansion. One such trend is the rise of eco-friendly tires, which are designed to minimize environmental impact without compromising on performance. These tires utilize innovative materials and manufacturing processes to reduce fuel consumption and carbon emissions, making them a sustainable choice for businesses and individuals alike.

Additionally, the advent of smart tires is revolutionizing the industry. These tires are equipped with advanced sensors that continuously monitor various parameters, such as tire pressure, temperature, and wear. This real-time data allows for proactive maintenance and optimized performance, ensuring maximum safety and efficiency on the road. With the increasing adoption of IoT (Internet of Things) technologies in tire manufacturing, the development of smart tires is expected to continue, further enhancing the overall driving experience.

Overall, the combination of eco-friendly and smart tires represents a significant advancement in the TBR tire market. These innovations not only address environmental concerns but also provide tangible benefits in terms of performance, safety, and cost-effectiveness. As the market continues to evolve, it will be interesting to see how these trends shape the future of the industry.

Furthermore, the growing emphasis on sustainability has led to the increasing production of eco-friendly tires, using renewable materials and energy-efficient processes. These factors, combined with the burgeoning demand for commercial vehicles, are anticipated to propel the global TBR tire market’s growth in the future.

Browse over market data Figures spread through 180 Pages and an in-depth TOC on “Global Truck and Bus Radial Tires Market” @ https://www.techsciresearch.com/report/truck-and-bus-radial-tires-market/22219.html

The Global Truck and Bus Radial Tires Market stands at the forefront of the commercial vehicle industry, playing a pivotal role in ensuring the efficiency, safety, and sustainability of the vast fleet of trucks and buses that traverse roads worldwide. This market is dynamic and evolving, driven by a combination of technological advancements, regulatory influences, and the ever-changing needs of the transportation sector.

A significant trend shaping the Truck and Bus Radial Tires Market is the increasing integration of smart tire technologies. These technologies, encompassing sensors embedded within the tire structure, enable real-time monitoring of essential parameters like tire pressure, temperature, and tread wear. The advent of smart tires marks a paradigm shift in tire management, providing fleet operators with actionable data to optimize maintenance schedules, enhance fuel efficiency, and prevent potential tire failures. The real-time monitoring capability contributes to improved safety, offering timely alerts to deviations in tire conditions and enabling proactive interventions.

Fuel efficiency is a paramount consideration in the commercial vehicle industry, driven by environmental concerns and operational cost considerations. The trend towards low rolling resistance in truck and bus radial tires reflects the industry’s commitment to reducing carbon emissions and enhancing fuel efficiency. Low rolling resistance tires are designed to minimize the energy required for a tire to roll, translating into fuel savings for fleet operators. As governments globally implement stricter regulations regarding emissions, tire manufacturers are increasingly focusing on technologies that align with these environmental standards, contributing to a greener and more sustainable transportation ecosystem.

Customization has emerged as a notable trend in the Truck and Bus Radial Tires Market, with manufacturers developing specialized solutions tailored to specific applications and operating conditions. The diverse environments in which commercial vehicles operate, from long-haul highway routes to urban stop-and-go traffic, necessitate tire designs that cater to unique challenges. Customized solutions optimize performance and longevity, recognizing the distinct needs of fleet operators. Tires designed for urban delivery vehicles, for instance, prioritize durability and resistance to curb damage, while those intended for long-haul applications focus on maximizing fuel efficiency and tread life.

Advancements in tire materials and construction techniques represent another key trend in the market. High-tech materials, such as silica-based compounds, contribute to superior wet traction, tread wear resistance, and overall tire performance. The internal components of radial tires, including belts and carcass structure, are continually optimized to enhance strength and flexibility, allowing for improved load-carrying capacity and stability. These advancements underscore the tire industry’s commitment to pushing the boundaries of innovation and delivering products that meet the evolving demands of the commercial vehicle sector.

Retreading solutions have gained momentum as a noteworthy trend in the Truck and Bus Radial Tires Market, offering a sustainable and cost-effective alternative. Retreading involves replacing the worn tread of a tire with a new layer, extending its lifespan and reducing the environmental impact associated with tire disposal. This approach aligns with circular economy principles, minimizing waste and maximizing resource efficiency. Retreaded tires provide a more affordable option for fleet operators, delivering comparable performance to new tires at a lower cost. Manufacturers are investing in advanced retreading technologies to ensure the quality and safety of retreaded truck and bus radial tires, fostering a holistic approach to tire lifecycle management.

The Global Truck and Bus Radial Tires Market’s trajectory is shaped by a confluence of these trends, responding to the multifaceted challenges and opportunities presented by the commercial vehicle industry. The industry’s ability to integrate smart technologies, focus on fuel efficiency, customize solutions for diverse applications, advance tire materials and construction, and embrace sustainable practices through retreading reflects a commitment to innovation and meeting the evolving needs of fleet operators and regulatory frameworks.

As the market continues to evolve, manufacturers and stakeholders in the Truck and Bus Radial Tires Market are poised to navigate the complexities of the commercial vehicle landscape. Technological advancements will likely persist, providing opportunities for further innovation, efficiency gains, and safety improvements. Sustainability considerations will remain a driving force, shaping the industry’s approach to materials, manufacturing processes, and end-of-life tire management. Ultimately, the Global Truck and Bus Radial Tires Market stands as a critical enabler of efficient, safe, and sustainable transportation, contributing to the resilience and evolution of the global commercial vehicle ecosystem.

Major companies operating in the Global Truck and Bus Radial Tires Market are:

- Apollo Tyres

- Balkrishna Industries Limited

- Bridgestone Corporation

- China National Tire & Rubber Co., Ltd.

- Continental AG

- Cooper Tire & Rubber Company

- Giti Tire

- The Goodyear Tire & Rubber Company

- Hankook Tire & Technology Co. Ltd.

- Kumho Tire Co., Inc.

To Download FREE Sample Pages of this Report📥 @ https://www.techsciresearch.com/sample-report.aspx?cid=22219

Customers can also request for 10% free customization on this report.

“The Truck and Bus Radial Tires Market plays a pivotal role in the global commercial vehicle industry, navigating trends that emphasize technological innovation, sustainability, and tailored solutions. With the integration of smart tire technologies, a focus on fuel efficiency, and customization for diverse applications, this market meets the evolving needs of fleet operators. Advancements in tire materials and retreading solutions underscore a commitment to performance and environmental responsibility. As a dynamic and vital sector, the Truck and Bus Radial Tires Market ensures the efficiency, safety, and sustainability of commercial transportation, contributing to the resilience and evolution of the global automotive landscape.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Truck and Bus Radial Tires Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Application (Truck, Bus), By Sales Channel (OEM, Aftermarket), By Region, Competition, 2019-2029”, has evaluated the future growth potential of Global Truck and Bus Radial Tires Market and provides statistics & information on market size, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision-makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Truck and Bus Radial Tires Market.

You may also read:

Automotive RADAR Applications Market Outlook & Forecast [2029]

Automotive OEM Market – [2029] Forecast, Growth, Trends

Automotive PVC Artificial Leather Market – Future, Scope, Trends [Latest]

Table of Content-Truck and Bus Radial Tires Market

- Introduction

1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

- Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

- Impact of COVID-19 on Global Truck and Bus Radial Tires Market

- Global Truck and Bus Radial Tires Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Application Market Share Analysis (Truck, Bus)

5.2.2. By Sales Channel Market Share Analysis (OEM, Aftermarket)

5.2.3. By Regional Market Share Analysis

5.2.3.1. Asia-Pacific Market Share Analysis

5.2.3.2. Europe & CIS Market Share Analysis

5.2.3.3. North America Market Share Analysis

5.2.3.4. South America Market Share Analysis

5.2.3.5. Middle East & Africa Market Share Analysis

5.2.4. By Company Market Share Analysis (Top 5 Companies, Others – By Value, 2023)

5.3. Global Truck and Bus Radial Tires Market Mapping & Opportunity Assessment

5.3.1. By Application Market Mapping & Opportunity Assessment

5.3.2. By Sales Channel Market Mapping & Opportunity Assessment

5.3.3. By Regional Market Mapping & Opportunity Assessment

- Asia-Pacific Truck and Bus Radial Tires Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Application Market Share Analysis

6.2.2. By Sales Channel Market Share Analysis

6.2.3. By Country Market Share Analysis

6.2.3.1. China Market Share Analysis

6.2.3.2. India Market Share Analysis

6.2.3.3. Japan Market Share Analysis

6.2.3.4. Indonesia Market Share Analysis

6.2.3.5. Thailand Market Share Analysis

6.2.3.6. South Korea Market Share Analysis

6.2.3.7. Australia Market Share Analysis

6.2.3.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Truck and Bus Radial Tires Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Application Market Share Analysis

6.3.1.2.2. By Sales Channel Market Share Analysis

6.3.2. India Truck and Bus Radial Tires Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Application Market Share Analysis

6.3.2.2.2. By Sales Channel Market Share Analysis

6.3.3. Japan Truck and Bus Radial Tires Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Application Market Share Analysis

6.3.3.2.2. By Sales Channel Market Share Analysis

6.3.4. Indonesia Truck and Bus Radial Tires Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Application Market Share Analysis

6.3.4.2.2. By Sales Channel Market Share Analysis

6.3.5. Thailand Truck and Bus Radial Tires Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Application Market Share Analysis

6.3.5.2.2. By Sales Channel Market Share Analysis

6.3.6. South Korea Truck and Bus Radial Tires Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Application Market Share Analysis

6.3.6.2.2. By Sales Channel Market Share Analysis

6.3.7. Australia Truck and Bus Radial Tires Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Application Market Share Analysis

6.3.7.2.2. By Sales Channel Market Share Analysis