Overview and Scope

Wealthtech solution refers to the use of technology to provide digital solutions and services aimed at optimizing the management of personal finances and wealth. It encompasses a broad range of innovations and applications that cater to various aspects of wealth management, investment advisory, and financial planning.

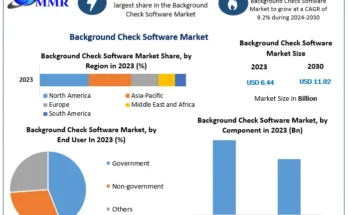

Sizing and Forecast

The wealthtech solutions market size has grown rapidly in recent years. It will grow from $4.72 billion in 2023 to $5.42 billion in 2024 at a compound annual growth rate (CAGR) of 14.7%. The growth in the historic period can be attributed to the emergence of online trading platforms, the rise of robo-advisors, the early adoption of mobile banking apps, growth of mutual funds and ETFs, introduction of low-cost trading options.

The wealthtech solutions market size is expected to see rapid growth in the next few years. It will grow to $9.43 billion in 2028 at a compound annual growth rate (CAGR) of 14.9%. The growth in the forecast period can be attributed to growing interest in digital financial services, Improved customer service, cybersecurity enhancements, rise of digital wealth management platforms, sustainable investing is gaining traction. Major trends in the forecast period include increased adoption of AI and machine learning, integration of blockchain technology, innovative wealthtech solutions, growing adoption of cloud computing, and adoption of big data analytics.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/wealthtech-solutions-global-market-report

Segmentation & Regional Insights

The wealthtech solutions market covered in this report is segmented –

1) By Components: Solution, Services

2) By Deployment Mode: Cloud, On-Premises

3) By Organization Size: Large Enterprises, Small And Medium-Sized Enterprises (SMEs)

4) By End User: Banks, Investment Firms, Wealth Management Firms, Other End-Users

North America was the largest region in the wealthtech solutions market in 2023. The regions covered in the wealthtech solutions market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16824&type=smp

Major Driver Impacting Market Growth

A growing interest in digital financial services is expected to propel the growth of the wealthtech solutions market going forward. Digital financial services (DFS) refer to a broad range of financial services delivered through digital channels such as mobile phones, the Internet, or other electronic devices. The increasing consumer expectations for personalized, efficient, and accessible wealth management services enabled by technological advancements boost the need for digital financial services. Digital financial services use wealth tech solutions to provide innovative and personalized wealth management and investment services through digital channels, enhancing accessibility and efficiency for users. For instance, in May 2024, according to FedPayments Improvement, a US-based product of Federal Reserve Banks, in 2023 digital wallets and mobile apps were adopted by 62% of businesses, a notable increase from 47% in 2022. Therefore, a growing interest in digital financial services is driving the growth of the wealthtech solutions market.

Key Industry Players

Major companies operating in the wealthtech solutions market are JPMorgan Chase & Co., Bank of America, Citigroup Inc., Wells Fargo & Company, BNP Paribas, Goldman Sachs, Barclays PLC, FMR LLC, BlackRock Inc., State Street Global Advisors, The Vanguard Group Inc., Lightspeed POS, Paymentus Holdings Inc., Angel One Limited, Verafin, Wealthfront Corporation, DriveWealth LLC, Aixigo AG, Valuefy, Moxtra, Trackinsight SAS, WealthTechs Inc., Advisor Software (ASI), Bridge Financial Technology

The wealthtech solutions market report table of contents includes:

1. Executive Summary

2. Wealthtech Solutions Market Characteristics

3. Wealthtech Solutions Market Trends And Strategies

4. Wealthtech Solutions Market – Macro Economic Scenario

5. Global Wealthtech Solutions Market Size and Growth

.

.

.

32. Global Wealthtech Solutions Market Competitive Benchmarking

33. Global Wealthtech Solutions Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Wealthtech Solutions Market

35. Wealthtech Solutions Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model