Introduction:

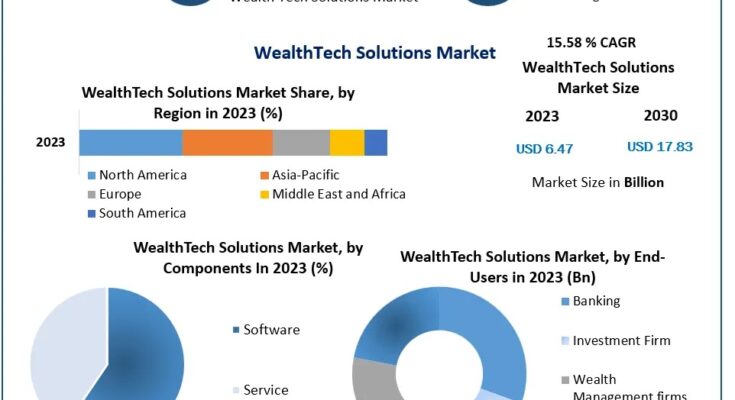

The Global WealthTech Solutions Market is witnessing transformative growth, driven by the rapid adoption of technology in the wealth management sector. With innovations in artificial intelligence, blockchain, big data, and robo-advisory services, WealthTech is revolutionizing how financial institutions and individuals manage and invest wealth. The market is poised for substantial growth, and this press release explores the key trends, drivers, and developments shaping the future of the WealthTech industry.

Click the below link for more details: https://www.maximizemarketresearch.com/request-sample/167061/

Key Market Drivers:

- Digital Transformation in Financial Services: The growing need for digital transformation in financial services is one of the key factors driving the WealthTech market. Technologies like AI, machine learning, and blockchain are enabling financial institutions to offer more efficient and personalized wealth management solutions.

- Demand for Personalized Wealth Management: Consumers today are increasingly looking for personalized, data-driven wealth management solutions. WealthTech platforms offer tailored investment strategies and financial advice, making them more attractive to both institutional and individual investors.

- Regulatory Changes and Compliance: Increasing regulatory pressures are pushing financial institutions to adopt advanced technologies that ensure compliance and streamline operations. WealthTech solutions help firms meet these regulatory demands while maintaining operational efficiency.

- Rising Wealth in Emerging Markets: The growing middle class and increasing wealth in emerging markets such as Vietnam, Thailand, Singapore, and South Korea are contributing to the demand for modern wealth management services.

Scope of the WealthTech Solutions Market Report:

by Deployment Type

1.Cloud

2.Premises

by Components

1.Software

2.Service

The wealthtech solution market is divided into solution and services segments based on component. The solution category commanded the most market share in 2023. The wealthtech solution’s rise is being driven by the widespread usage of automation solutions across sectors. The expectations of the younger generation of clients, such as tech-enabled financial solutions, automated rebalancing, and portfolio construction, are being understood by many large banks and small consulting firms. They are also concentrating on transforming the industry by identifying inefficiencies across the financial services value chain. Wealth management software providers provide cloud-based solutions for asset and wealth managers, as well as private banking departments, to boost client happiness, streamline and digitize the whole value chain, enhance reporting, and recover margins.

by Organization Size

1.Large Enterprises

2.Small-Medium Size Enterprise

by End-Users

1.Banking

2.Investment Firm

3.Wealth Management firms

4.Others

Click the below link for more details: https://www.maximizemarketresearch.com/request-sample/167061/

Mergers and Acquisitions: Key Moves in the WealthTech Market

- Strategic Acquisitions: The WealthTech sector has seen significant mergers and acquisitions (M&A) in recent years. Major players are acquiring fintech startups to integrate new technologies and expand their service offerings. For instance, Fidelity Investments and Vanguard have both acquired startups that focus on robo-advisory solutions to enhance their portfolios.

- Consolidation of Financial Institutions: Large financial institutions are consolidating their positions in the WealthTech space by merging with smaller tech firms, thereby increasing their digital capabilities. Notable examples include JPMorgan Chase’s acquisition of You Invest and UBS’s investment in digital asset management platforms.

WealthTech Solutions Market, Key Players are:

1. Acorns

2. Active Asset Allocation

3.Additiv

4.Advestis

5.Advisor Software

6. Advize

7. Aixigo

8.Albert

9.Allocare

10. Aspiration

11. BestInvest

12. Bitbond

13. Calastone

14. Comply Advantage

15.ComplySci

Click the below link for more details: https://www.maximizemarketresearch.com/request-sample/167061/

Key Developments in WealthTech Solutions:

- Vietnam and Thailand: In Southeast Asia, countries like Vietnam and Thailand are experiencing rapid adoption of WealthTech solutions. The rise of mobile banking, digital payments, and investment platforms is democratizing access to wealth management services, particularly in rural areas where traditional banking infrastructure is limited.

- Singapore: Singapore continues to lead in WealthTech innovation in Asia. The city-state has become a hub for fintech startups, with numerous firms offering blockchain-based investment platforms, robo-advisory services, and AI-driven financial planning tools. The Monetary Authority of Singapore (MAS) is actively fostering a conducive environment for WealthTech development.

- Japan and South Korea: Both Japan and South Korea are home to some of the most advanced WealthTech ecosystems in the world. These countries are seeing a surge in the adoption of AI-based investment tools and robo-advisors, catering to both retail and institutional investors. Companies like Rakuten Securities in Japan and Kakao Pay in South Korea are expanding their WealthTech offerings.

- European Market: In Europe, the UK, Germany, and France remain key players in the WealthTech market. Companies are increasingly integrating digital wealth management tools with traditional services. Fintech firms like Nutmeg and Moneyfarm in the UK are growing rapidly, offering users low-cost, automated investment advice.

- United States: The US is at the forefront of the WealthTech revolution, with major players like Betterment, Wealthfront, and Charles Schwab driving innovations in automated investing, financial planning, and personalized advisory services. The rise of ESG (Environmental, Social, and Governance) investing platforms has also created new opportunities in the market.

Click here for a more detailed explanation: https://www.maximizemarketresearch.com/market-report/wealthtech-solutions-market/167061/

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

Market Segmentation – A detailed analysis by segment with their sub-segments and Region

Competitive Landscape – Profiles of selected key players by region from a strategic perspective

Competitive landscape – Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER’s analysis

Value chain and supply chain analysis

Legal Aspects of Business by Region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐃𝐢𝐬𝐜𝐨𝐯𝐞𝐫 𝐖𝐡𝐚𝐭’𝐬 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠:

♦ Bonding Films Market https://www.maximizemarketresearch.com/market-report/bonding-films-market/2499/

♦ Global N95 Mask Market https://www.maximizemarketresearch.com/market-report/global-n95-mask-market/105931/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Composite Rebar Market to Reach USD 11.3 Billion by 2030 with a CAGR of 7.4%